The Dark Cloud Cover is a bearish reversal candlestick pattern that signals a potential momentum shift to the downside after a prolonged uptrend. It consists of two candles:

- First Candle: A long bullish (white or green) candle, indicating that buyers were in control of the market.

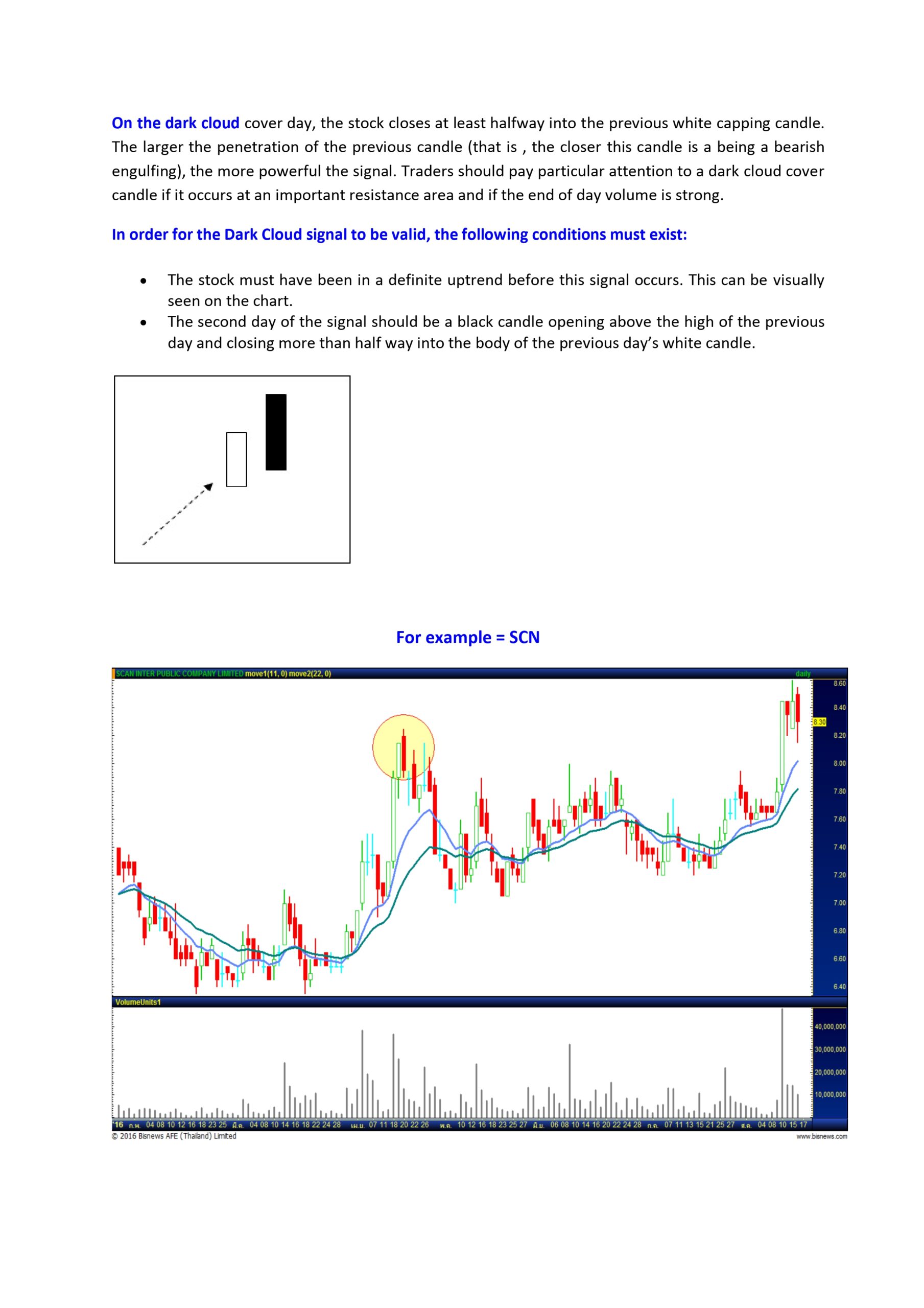

- Second Candle: A long bearish (black or red) candle that opens above the high of the previous bullish candle but closes below the midpoint of the first candle’s body. This shows that sellers have taken over and pushed prices lower.

Key Characteristics of Dark Cloud Cover:

- Prolonged Uptrend: The pattern is most reliable when it appears after a significant uptrend, suggesting the bulls are losing control.

- First Candle: This candle shows strong bullish sentiment, with a long body indicating significant upward movement.

- Second Candle: The bearish candle’s opening above the previous high signals initial bullish continuation, but the close below the midpoint of the first candle signals a reversal in sentiment as bears take control.

Trading the Dark Cloud Cover Pattern:

- Identification: Look for the pattern at the end of an uptrend.

- Confirmation: For added reliability, wait for the following session to produce a bearish candle that breaks below the low of the Dark Cloud Cover pattern.

- Entry Point: Enter a short position when the price breaks below the low of the second (bearish) candle.

- Stop Loss: Place a stop loss above the high of the second (bearish) candle to manage risk.

- Profit Target: Determine profit targets using other technical analysis tools, such as support levels, Fibonacci retracements, or moving averages.

Comparison with Bearish Engulfing Pattern:

- Bearish Engulfing: The second candle completely engulfs the body of the first candle, opening above and closing below the first candle’s body.

- Dark Cloud Cover: The second candle closes below the midpoint of the first candle’s body but does not necessarily engulf it.

The Dark Cloud Cover pattern is significant because it provides traders with an early indication to exit long positions or enter short positions, potentially capitalizing on an emerging downward trend. However, like all candlestick patterns, it should be used in conjunction with other technical analysis methods and indicators to increase its reliability and effectiveness.

What is the difference between dark cloud cover and bearish engulfing pattern

The main differences between the Dark Cloud Cover and Bearish Engulfing candlestick patterns are:

- The Dark Cloud Cover pattern consists of a long bullish candle followed by a bearish candle that opens above the high of the previous candle but closes below the midpoint of the bullish candle’s body

. The Bearish Engulfing pattern consists of a small bullish candle followed by a larger bearish candle that completely engulfs the previous bullish candle. The Bearish Engulfing pattern is considered a stronger bearish reversal signal compared to the Dark Cloud Cover pattern. The Bearish Engulfing pattern indicates a more dramatic shift from bullish to bearish momentum. The Dark Cloud Cover pattern requires the second bearish candle to open above the high of the first bullish candle and close below the midpoint of the bullish candle’s body. This is not a requirement for the Bearish Engulfing pattern. While both patterns are bearish, the Dark Cloud Cover pattern preserves some of the gains from the previous bullish candle, whereas the Bearish Engulfing pattern completely rejects the gains of the previous bullish candle

- .

In summary, the key differences lie in the strength of the bearish reversal signal, the specific requirements for the second candle, and the degree to which the second candle rejects the gains of the previous bullish candle.