The world of cryptocurrency trading has seen exponential growth over the past decade, offering traders a variety of ways to engage with digital assets. One popular method is through Crypto Contracts for Difference (CFDs). This guide will delve into the essentials of trading crypto CFDs, covering everything from the basics to advanced strategies.

What are Crypto CFDs?

A Contract for Difference (CFD) is a financial derivative that allows traders to speculate on the price movements of an underlying asset without owning it. When trading crypto CFDs, the underlying asset is a cryptocurrency. The trader and the broker agree to exchange the difference in the asset’s price from the opening to the closing of the contract. This allows traders to profit from both rising (going long) and falling (going short) markets.

Advantages of Trading Crypto CFDs

- Leverage: CFDs often allow traders to use leverage, meaning they can control a large position with a relatively small amount of capital. This amplifies both potential profits and losses.

- No Ownership: Since CFDs are derivatives, traders do not own the underlying cryptocurrency. This means they can avoid the complexities and security risks associated with holding digital assets.

- Flexibility: Traders can easily switch between long and short positions, enabling them to profit from market movements in both directions.

- Diverse Markets: CFD brokers typically offer a range of cryptocurrencies to trade, providing opportunities to capitalize on various market trends.

Risks Involved

While trading crypto CFDs can be profitable, it comes with significant risks:

- Leverage Risks: High leverage can lead to substantial losses, sometimes exceeding the initial investment.

- Volatility: Cryptocurrencies are notoriously volatile, which can result in sudden and large price swings.

- Counterparty Risk: As CFDs are over-the-counter products, traders are exposed to the risk that the broker may default on its obligations.

- Regulatory Risks: The regulatory environment for cryptocurrencies and CFDs can change rapidly, potentially impacting market conditions.

Getting Started with Crypto CFD Trading

1. Choosing a Broker

Selecting a reliable broker is crucial. Consider the following factors:

- Regulation: Ensure the broker is regulated by a reputable financial authority.

- Fees and Spreads: Compare trading fees and spreads to ensure competitive pricing.

- Platform: The trading platform should be user-friendly and offer robust analytical tools.

- Leverage: Check the leverage options and ensure they suit your trading style and risk tolerance.

- Customer Support: Good customer service is essential for resolving issues quickly.

2. Account Setup

Once you have chosen a broker, follow these steps to set up your account:

- Registration: Complete the registration process by providing your personal information and verifying your identity.

- Deposit Funds: Deposit the required minimum amount into your trading account.

- Choose a Trading Platform: Most brokers offer proprietary platforms or popular third-party platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

3. Developing a Trading Plan

A well-structured trading plan is essential for success. It should include:

- Trading Goals: Define your short-term and long-term trading objectives.

- Risk Management: Determine your risk tolerance and set stop-loss and take-profit levels accordingly.

- Strategy: Develop a strategy based on technical and/or fundamental analysis.

- Record Keeping: Maintain a trading journal to track performance and refine your strategy over time.

Trading Strategies

1. Technical Analysis

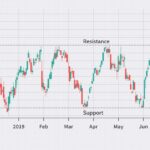

Technical analysis involves studying price charts and using indicators to predict future price movements. Common tools include:

- Moving Averages: Identify trends and potential reversal points.

- Relative Strength Index (RSI): Measure the strength of price movements to identify overbought or oversold conditions.

- Bollinger Bands: Assess market volatility and potential breakouts.

2. Fundamental Analysis

Fundamental analysis involves evaluating the underlying factors that influence cryptocurrency prices, such as:

- News and Events: Monitor news related to regulatory changes, technological advancements, and market sentiment.

- On-Chain Data: Analyze blockchain data to understand network activity and investor behavior.

- Macroeconomic Factors: Consider broader economic conditions that could impact the cryptocurrency market.

3. Sentiment Analysis

Sentiment analysis gauges market sentiment by analyzing social media, forums, and news articles. Tools like sentiment indices can help identify the prevailing market mood.

4. Arbitrage

Arbitrage involves exploiting price differences of the same asset across different markets. In crypto CFD trading, this could mean identifying price discrepancies between different CFD brokers.

Risk Management

Effective risk management is crucial for long-term success. Consider the following strategies:

- Position Sizing: Determine the appropriate position size based on your risk tolerance and the trade’s potential.

- Stop-Loss Orders: Use stop-loss orders to limit potential losses.

- Diversification: Spread your capital across multiple trades and assets to mitigate risk.

- Regular Reviews: Periodically review your trading performance and adjust your strategy as needed.

Conclusion

Trading crypto CFDs can be a profitable endeavor, but it requires a thorough understanding of the market, a well-structured trading plan, and effective risk management. By leveraging technical and fundamental analysis, staying informed about market trends, and continuously refining your strategy, you can navigate the complexities of crypto CFD trading and capitalize on the opportunities it presents. Always remember that while the potential for high returns exists, so does the risk of significant losses. Trade responsibly and stay informed.