The “Tower Top Pattern,” also known simply as the “Tower Pattern,” is a chart pattern used in technical analysis to identify potential reversals in the price of an asset. This pattern is less common than other patterns but can be a powerful signal when it appears. It is typically found in candlestick charts.

Characteristics of the Tower Top Pattern

- Formation:

- The pattern forms after a strong uptrend.

- It consists of a series of candlesticks that create a structure resembling a tower with a flat or rounded top.

- Components:

- Strong Uptrend: The pattern is preceded by a significant upward price movement.

- Consolidation at the Top: After the uptrend, the price consolidates, forming a series of small-bodied candlesticks (doji or spinning tops) that indicate indecision and potential reversal.

- Bearish Candlestick: The pattern is confirmed by a large bearish candlestick that breaks below the consolidation range, signaling the start of a downtrend.

- Volume:

- Volume often decreases during the consolidation phase, indicating weakening bullish momentum.

- A spike in volume on the bearish candlestick can further confirm the reversal.

Interpretation and Trading Strategy

- Confirmation:

- Traders typically wait for the bearish candlestick to close below the consolidation range to confirm the pattern.

- Additional indicators such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) can be used to validate the signal.

- Entry Point:

- A short position can be entered once the bearish candlestick closes below the support level of the consolidation range.

- Some traders may wait for a pullback to the broken support level (now acting as resistance) before entering the trade.

- Stop Loss:

- A stop loss can be placed above the highest point of the consolidation range to limit potential losses.

- Profit Target:

- The profit target can be set based on the previous support levels or by using a measured move technique, where the height of the consolidation range is projected downward from the breakout point.

Example

Let’s consider an example where a stock has been in a strong uptrend and starts forming small-bodied candlesticks at the top, creating a flat top structure. After a few days of consolidation, a large bearish candlestick appears and closes below the consolidation range. This indicates that the uptrend has exhausted, and a reversal might be imminent. Traders who recognize this pattern might enter a short position, set a stop loss above the consolidation range, and aim for a profit target based on previous support levels.

Summary

The Tower Top Pattern is a bearish reversal pattern that signals the end of an uptrend and the beginning of a downtrend. By identifying the consolidation phase and waiting for the bearish confirmation candlestick, traders can potentially capitalize on the ensuing price decline. As with all technical patterns, it’s important to use additional analysis and risk management strategies to enhance the effectiveness of the trade.

What is the difference between tower top and tower bottom candlestick patterns

The Tower Top and Tower Bottom candlestick patterns are both multi-day trend reversal patterns used in technical analysis to identify potential reversals in the market. Here are the key differences between the two patterns:

- Tower Top Candlestick Pattern:

- Formation: The Tower Top pattern occurs after an uptrend and consists of a longer bullish candlestick on Day 1, followed by smaller body candlesticks, and finally, a large bearish candlestick on the last day, forming a tower-like structure.

- Psychology: The bullish candlestick on Day 1 confirms the previous uptrend, but subsequent days of small body candlesticks indicate a slowdown in momentum. The large bearish candlestick signals a change in sentiment and a potential reversal.

- Requirements: It occurs during an uptrend, with the first candle being a long, white candle, followed by spinning tops during the sideways phase, and ending with a long, dark candle signaling the reversal.

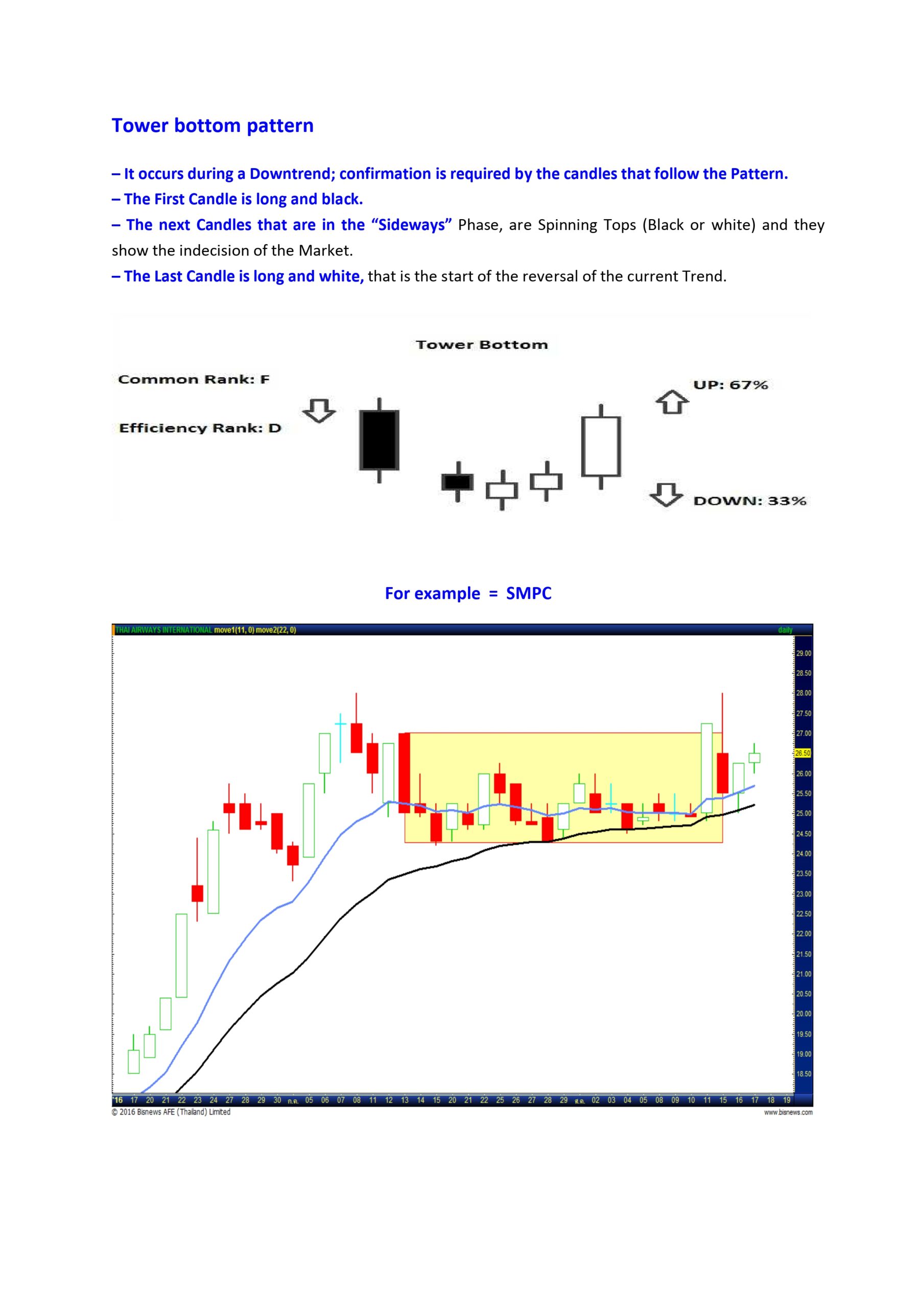

- Tower Bottom Candlestick Pattern:

- Formation: The Tower Bottom pattern is a bullish reversal pattern that typically appears at the bottom of a prolonged downtrend. It includes a tall red candlestick at the end of the decline, followed by smaller bearish candlesticks, and completed by a large bullish candlestick, forming a tower-like structure.

- Psychology: The pattern signifies a bullish reversal, indicating exhaustion of sellers before buyers regain control. It suggests a potential shift in market sentiment and the start of an uptrend.

- Requirements: To spot a Bullish Tower Bottom pattern, look for a tall red candlestick followed by smaller bearish candlesticks that do not break below the closing price of the tall red candlestick, ending with a large bullish candlestick at the same price level as the bearish candlestick from earlier.

In summary, the Tower Top pattern indicates a potential bearish reversal after an uptrend, while the Tower Bottom pattern suggests a bullish reversal after a downtrend, with each pattern having specific candlestick formations and psychological implications