The In Neck Line (Irikubi) is a candlestick pattern that appears in a downtrend and is characterized by a long black candle followed by a smaller white candle that closes at or slightly above the previous day’s close. This pattern is often seen as a continuation of the downtrend, indicating that the bears are still in control. Here are the key features and implications of the In Neck Line:

Key Features:

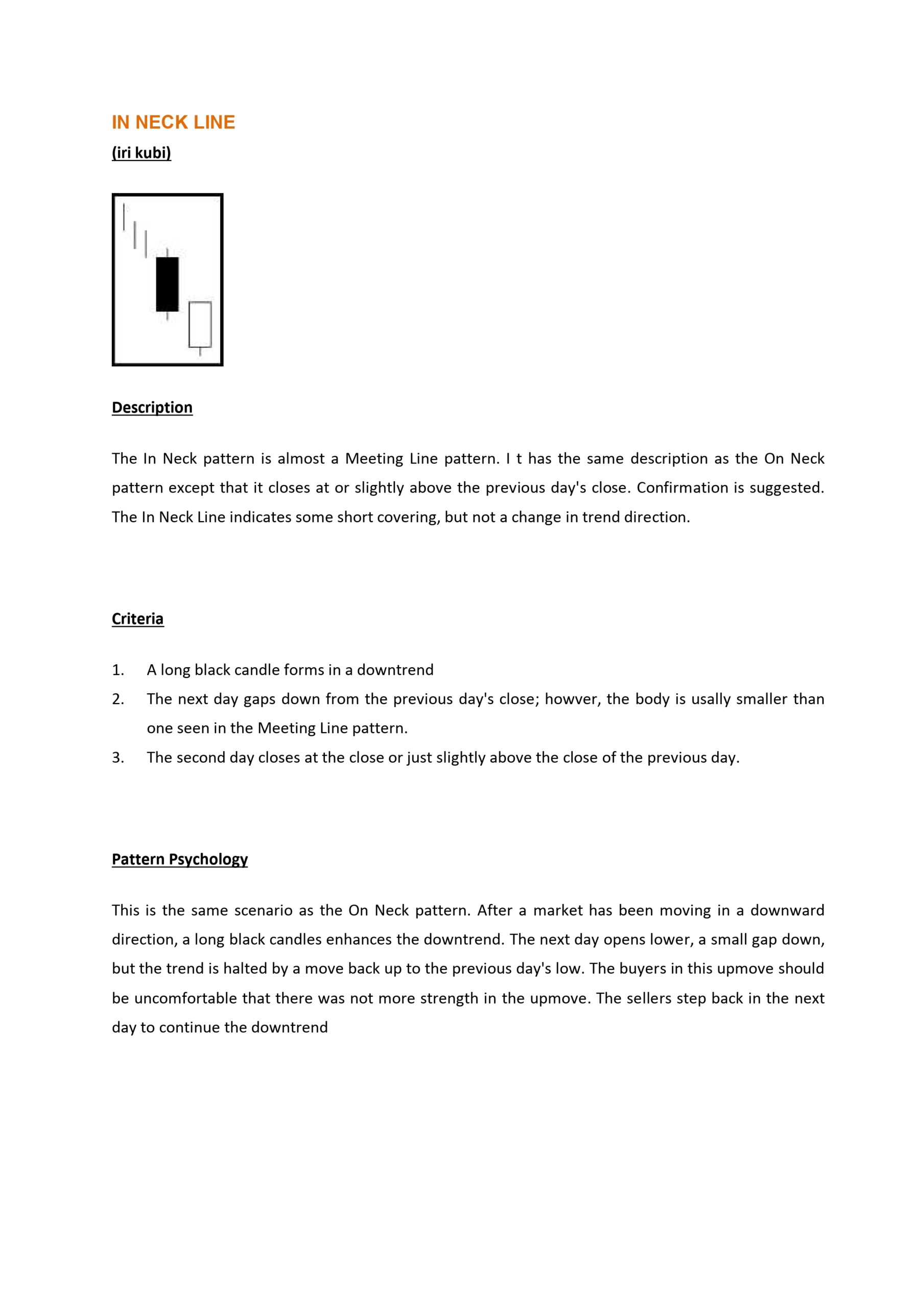

- Long Black Candle: The first candle is a long black candle, indicating a strong bearish sentiment.

- Smaller White Candle: The second candle is a smaller white candle that gaps down from the previous day’s close but closes at or slightly above the previous day’s close.

- Closing Price: The closing price of the second candle is at or slightly above the previous day’s close, indicating some short covering but not a significant change in trend direction.

Pattern Psychology:

- Bearish Continuation: The In Neck Line is a bearish continuation pattern, suggesting that the downtrend will continue.

- Short Covering: The second candle’s closing price at or slightly above the previous day’s close indicates some short covering, but this is not a significant reversal.

- Uncertainty: The pattern leaves both bears and bulls uncertain about the future price direction, as the bulls’ lack of strength in the upmove is seen as a sign of weakness.

Confirmation:

- Confirmation: The pattern is confirmed by a following candle closing below the second candle’s closing price, indicating a continuation of the downtrend.

Statistics:

- Frequency: The In Neck Line is a relatively rare pattern, occurring in about 0.03% of all candlestick patterns.

- Efficiency: The pattern has a low efficiency, indicating that it is not a reliable indicator of future price movements.

Overall, the In Neck Line is a bearish continuation pattern that suggests the downtrend will continue, but it is not a reliable indicator and should be used in conjunction with other technical analysis tools for more accurate predictions.

what are the key differences between the In Neck and On Neck patterns

The key differences between the In Neck and On Neck patterns are:

- Closing Price:

- In Neck Pattern: The second candle closes at or slightly above the previous day’s close, indicating some short covering but not a change in trend direction[1][4].

- On Neck Pattern: The second candle closes at the same level as the previous day’s close or almost there, forming a horizontal line that resembles a “neckline”.

- Confirmation:

- In Neck Pattern: Confirmation is suggested, indicating some short covering but not a change in trend direction[4].

- On Neck Pattern: Confirmation is not explicitly mentioned, but it is implied that the pattern is a continuation of the downtrend.

- Pattern Psychology:

- In Neck Pattern: The pattern indicates some short covering, but the trend direction remains unchanged[4].

- On Neck Pattern: The pattern suggests that the bears are in control, and the downtrend will continue[1][2][3].

- Frequency and Efficiency:

- In Neck Pattern: The frequency of the pattern is not mentioned, but it is implied to be less common than the On Neck pattern[4].

- On Neck Pattern: The pattern is relatively rare, occurring in about 0.03% of all candlestick patterns[1].

In summary, the main differences between the In Neck and On Neck patterns are the closing price of the second candle and the confirmation provided by the pattern. The In Neck pattern indicates some short covering but not a change in trend direction, while the On Neck pattern suggests a continuation of the downtrend.

how often does the In Neck pattern appear in candlestick charts

The In Neck pattern is a relatively rare pattern. It appears in about 0.03% of all candlestick patterns.

how does the In Neck pattern differ from the On Neck pattern in terms of trader psychology

The In Neck and On Neck patterns differ in terms of trader psychology as follows:

In Neck Pattern:

- Bearish Continuation: The In Neck pattern suggests that the bears are still in control, but the trend is not as intense as the On Neck pattern. This implies that the bears are maintaining their grip on the market, but there is some short covering, which might lead to a temporary pause or slight upward movement.

- Uncertainty: The In Neck pattern leaves both bulls and bears uncertain about the future price direction, as the bulls’ lack of strength in the up move is seen as a sign of weakness[4].

On Neck Pattern:

- Bearish Continuation: The On Neck pattern is a stronger bearish continuation pattern, indicating that the bears are in complete control and the downtrend will continue with more intensity.

- Confirmation: The On Neck pattern provides more confirmation of the downtrend, as the second candle closes at or very near the previous candle’s low, indicating a stronger bearish sentiment.

In summary, the In Neck pattern suggests a less intense bearish trend with some short covering, while the On Neck pattern indicates a stronger bearish trend with more confirmation of the downtrend.