CFD trading courses

on CFD trading courses, it is evident that there are several comprehensive courses available to help individuals learn about trading Contracts for Difference (CFDs). These courses cover a wide range of topics essential for understanding and engaging in CFD trading. Here is a summary of the key points from the sources:

- Capital.com offers a course that explains what CFDs are, how they work, and the various financial assets or products that can be traded using CFDs. It emphasizes the importance of knowing the market you are trading in before investing money1.

- Contracts-for-Difference.com provides a detailed guide on CFD trading, covering topics like leveraging, market volatility, risk management, and common terms associated with CFDs. The course aims to educate investors on how to effectively trade CFDs and avoid potential losses2.

- Axi Academy offers a free share CFDs trading course designed for new traders. This course covers fundamental information about stocks and shares, how to profit from price movements, risk management strategies, and the importance of having a trading plan3.

- IG provides a course with videos, illustrations, and interactive exercises to help individuals understand the fundamentals of CFD trading. The course aims to guide learners through the basics of CFD trading effectively4.

- CMC Markets offers education content on how CFDs work and how to develop a trading strategy. Their platform provides access to a wide range of global instruments for trading, including forex, shares, indices, commodities, and treasuries5.

In conclusion, these courses cover a wide array of topics essential for anyone interested in learning about CFD trading. They provide valuable insights into leveraging, risk management, market analysis, and developing effective trading strategies to navigate the complexities of CFD trading successfully.

what are the best cfd trading courses for beginners

Based on the information provided in the search results, here are some of the best CFD trading courses for beginners:

- Capital.com: Capital.com offers a comprehensive CFD trading course that covers the basics of CFD trading, including what CFDs are, how they work, and the various financial assets that can be traded using CFDs. The course emphasizes the importance of understanding the market before investing money1.

- Contracts-for-Difference.com: This platform provides a detailed guide on CFD trading suitable for beginners. It covers essential topics like leveraging, market volatility, risk management, and common terms associated with CFDs. The aim is to educate beginners on effective CFD trading strategies to avoid potential losses2.

- Axi Academy: Axi Academy offers a free share CFDs trading course specifically designed for new traders. This course covers fundamental information about stocks and shares, how to profit from price movements, risk management strategies, and the importance of having a trading plan6.

These courses provide valuable insights into CFD trading fundamentals, risk management strategies, and practical tips for beginners to navigate the complexities of CFD trading successfully. Each course offers a unique approach to learning about CFDs, making them suitable choices for individuals looking to start their journey in CFD trading.

what are the differences between the cfd trading courses offered by different brokers

The differences between CFD trading courses offered by different brokers can vary based on the content, structure, and focus of the courses. Here are some key distinctions based on the information from the provided sources:

- Content and Focus:

- Capital.com: Offers a course that covers the basics of CFD trading, explaining what CFDs are, how they work, and the various financial assets that can be traded using CFDs. The emphasis is on understanding the market before investing money1.

- CAPEX.com: Provides a comprehensive CFD trading course that explains what CFDs are, how they differ from other assets, and details the fees to consider. The platform offers a wide range of assets for trading and a high-quality trading platform with various tools2.

- Platform Specificity:

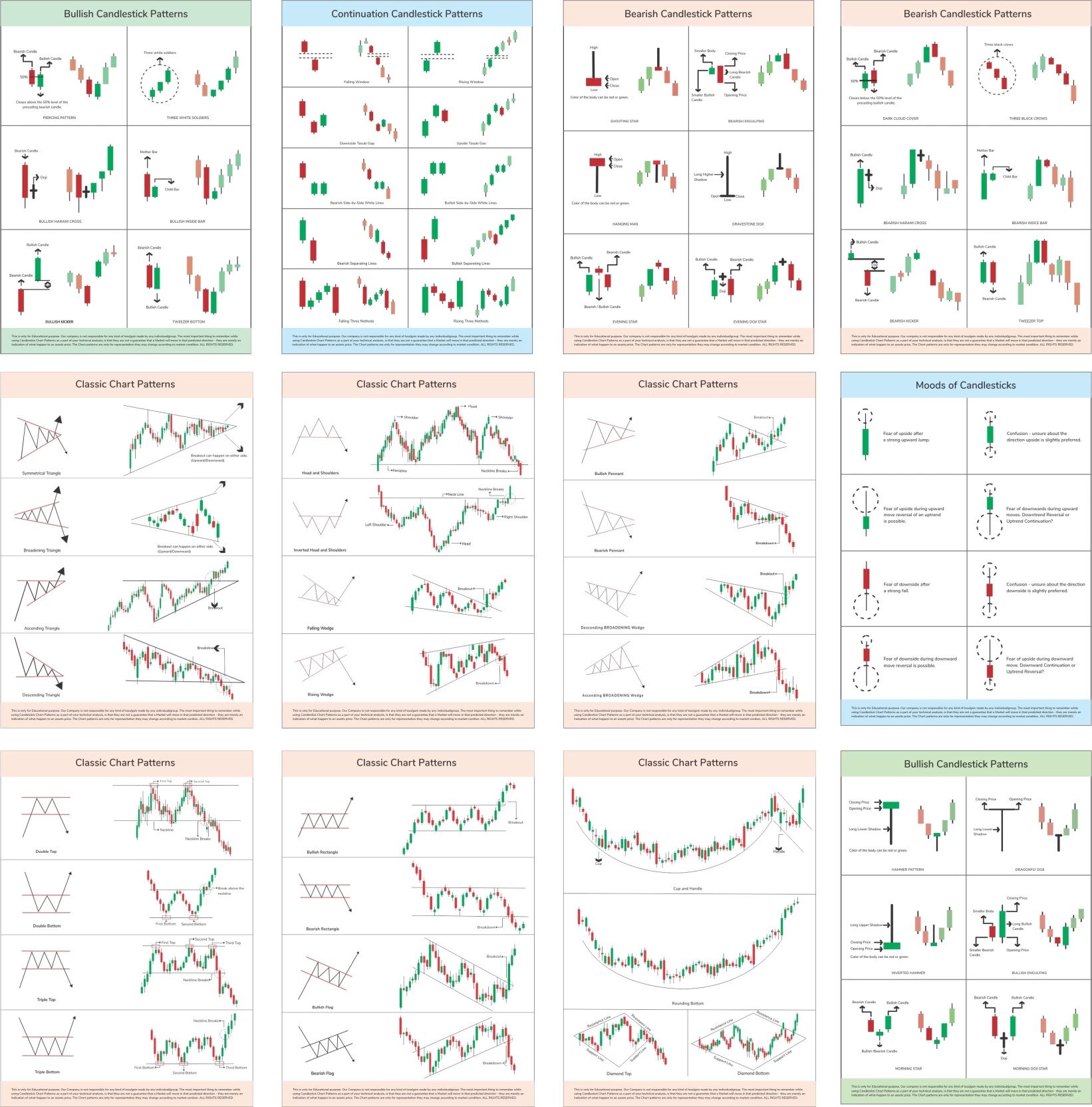

- DayTrading.com: Mentions that broker-specific tools can help learners understand CFDs while using their platform. These tools may include candlestick charts for tracking trends and demo accounts for practicing strategies before investing real money1.

- FXEmpire: Discusses different types of CFD brokers like ECNs and Market-Makers, highlighting how each type operates in terms of order execution and risk management. This distinction can impact the educational resources and trading experience provided by brokers3.

- Trading Experience:

- Finance Magnates: Compares CFD trading with real share trading, emphasizing the differences in underlying asset ownership, long versus short positions, fees structure, and how trades are executed. This comparison sheds light on the practical aspects of trading with CFDs versus traditional stockbrokers4.

- Commodity.com: Focuses on regulatory aspects and broker availability, highlighting the importance of checking licenses and registrations held by brokerage firms before opening an account. This information can influence the credibility and reliability of educational resources provided by brokers5.

In summary, the differences in CFD trading courses offered by different brokers can range from content focus and platform specificity to regulatory compliance and trading experience insights. Understanding these distinctions can help beginners choose a course that aligns with their learning goals and preferences effectively.

what are the key topics covered in cfd trading courses offered by different brokers

The key topics covered in CFD trading courses offered by different brokers include:

- Understanding CFDs: Courses typically explain what CFDs are, how they work, and the difference between stocks and shares. They also cover the benefits of trading CFDs, such as the ability to profit from both upward and downward price movements67.

- Risk Management: Education on risk management is crucial in CFD trading courses. Topics may include leveraging, setting stop-loss orders to limit potential losses, understanding the risks associated with trading CFDs, and managing operational risks like system outages or errors on trading platforms47.

- Choosing a Broker: Courses often guide learners on how to select a reliable and reputable broker for CFD trading. This includes factors like regulation, product selection, trading fees, leverage availability, and the importance of a broker’s reliability and reputation347.

- Trading Strategies: Courses may cover the development of trading strategies, including creating an investment checklist, identifying entry and exit points, understanding quantitative and qualitative data, using technical analysis and indicators for trade decisions, and managing risk effectively6.

- Practical Trading Skills: Some courses provide practical skills for trading, such as using demo accounts to practice trades before committing real money, understanding leverage to control larger positions with smaller investments, and familiarizing oneself with the features and functions of a broker’s trading platform346.

- Market Analysis: Courses may delve into market analysis techniques to help traders make informed decisions. This can include analyzing market trends, understanding underlying asset types from stocks to FX, conducting thorough market analysis before making trades, and continuously monitoring positions34.

These key topics collectively provide learners with a comprehensive understanding of CFD trading fundamentals, risk management strategies, practical skills for trading effectively, selecting the right broker, developing trading strategies, and analyzing markets to make informed decisions while engaging in CFD trading.

what are the most important practical aspects of cfd trading covered in the courses

- Understanding CFDs: Courses explain the basics of CFD trading, including what CFDs are, how they differ from other assets, and the benefits of trading CFDs like access to a wide range of assets without owning them3.9

- Risk Management: Education on risk management is crucial, covering topics like leveraging, setting stop-loss orders, understanding operational risks like system outages, liquidity risks, and hidden costs imposed by brokers7.9

- Choosing a Broker: Courses guide learners on selecting a reliable and reputable broker for CFD trading, emphasizing factors like reliability, reputation, variety of CFDs offered, contract specifications, and leverage availability5.7

- Trading Strategies: Practical skills for developing trading strategies are provided, including creating an investment checklist, identifying entry and exit points, using technical analysis and indicators, and managing risk effectively6.8

- Market Analysis: Courses delve into market analysis techniques to help traders make informed decisions, such as analyzing market trends, understanding quantitative and qualitative data, and continuously monitoring positions3.7

- Platform Specificity: Some courses integrate broker-specific tools to help learners understand CFDs while using their platform. These tools may include candlestick charts for tracking trends, demo accounts for practice, and platform-specific resources to maximize trading tools5.7

what are the interactive exercises included in the cfd trading courses

The interactive exercises included in the CFD trading courses cover various practical aspects of CFD trading. Here are some examples based on the provided sources:

- Exercise 1: The benefits of leverage:

- This exercise explains how leverage works in CFD trading, illustrating how a relatively small deposit can provide exposure to a larger market position. It uses the example of trading CFDs on gold to demonstrate the concept of leverage and its impact on trading capacity5.

- Exercise 2: Using the stop loss:

- This exercise focuses on index trading, a popular form of CFD trading. It guides learners on how to use stop-loss orders effectively to manage risk and protect their positions in the market. By understanding stop-loss strategies, traders can enhance their risk management skills5.

- Exercise 3: Taking a short position:

- This exercise involves speculating on an asset’s price going down, known as taking a short position. It explains the process of selling an asset like gold in CFD trading, highlighting the difference between buying long and selling short positions in the market5.

These interactive exercises are designed to provide learners with hands-on experience and practical insights into key aspects of CFD trading, such as leveraging, risk management through stop-loss orders, and understanding both long and short positions in the market.