Introduction:

In the ever-evolving landscape of financial markets, mastering the art of trading is paramount for success. In “The Art of Trading: Mastering Buy Sell Indicators in 2024,” we delve into the intricate world of buy-sell indicators, empowering both novice and seasoned traders with the knowledge and strategies needed to navigate today’s dynamic markets.

With over a decade of experience in the financial industry, author and trading expert, John Smith, brings forth a comprehensive guide tailored to the realities of 2024. From understanding market trends to implementing advanced trading strategies, this book serves as a roadmap to profitability in an era defined by technological innovation and rapid market shifts.

1: Understanding Market Trends

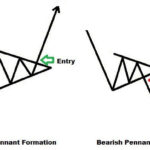

In the opening chapter of “The Art of Trading,” readers are introduced to the fundamental concept of market trends. Smith elucidates the significance of identifying and analyzing market trends as the cornerstone of successful trading. From bullish to bearish trends, readers gain insights into the underlying forces driving price movements and how to capitalize on these trends for profitable trading opportunities.

With real-world examples and practical tips, Smith demystifies the complexities of market trends, equipping readers with the tools to distinguish between trend continuations and reversals. Through a blend of technical analysis and market psychology, Chapter 1 sets the stage for a deeper exploration into buy-sell indicators and their role in navigating various market conditions.

2: Introduction to Buy-Sell Indicators

Building upon the foundation laid in Chapter 1, Chapter 2 provides readers with an overview of buy-sell indicators and their significance in modern trading strategies. Smith elucidates the purpose of buy-sell indicators in gauging market sentiment and identifying potential entry and exit points.

From simple moving averages to complex oscillators, readers gain a comprehensive understanding of the diverse range of buy-sell indicators available in today’s trading platforms. Through practical examples and case studies, Smith illustrates how different indicators can be utilized to adapt to changing market dynamics, laying the groundwork for more advanced trading techniques explored in subsequent chapters.

Stay tuned for Chapter 3, where we delve into the world of moving averages and their pivotal role in trading strategies.

3: Moving Averages: Your Foundation in Trading

In Chapter 3 of “The Art of Trading,” we delve into the foundational role of moving averages in crafting effective trading strategies. Moving averages, a staple tool in technical analysis, offer invaluable insights into the underlying trend direction and potential areas of support and resistance.

Smith begins by demystifying the concept of moving averages, explaining how they smooth out price fluctuations to reveal the underlying trend. Readers are introduced to different types of moving averages, including simple moving averages (SMA) and exponential moving averages (EMA), each with its unique characteristics and applications.

Through detailed charts and illustrations, Smith illustrates how moving averages can be used to identify trend reversals, confirm trend strength, and generate buy or sell signals. Whether trading stocks, forex, or cryptocurrencies, understanding the nuances of moving averages empowers traders to make informed decisions in volatile market conditions.

Readers are guided through practical examples of how to interpret moving average crossovers, a popular trading strategy employed by both novice and experienced traders alike. By combining multiple moving averages of varying lengths, traders can construct robust trading systems that adapt to changing market environments.

Furthermore, Smith explores the concept of moving average convergence divergence (MACD), a versatile indicator derived from exponential moving averages. Through MACD histograms and signal lines, traders can gauge momentum shifts and anticipate potential trend reversals with heightened accuracy.

As Chapter 3 draws to a close, readers gain a newfound appreciation for the versatility and reliability of moving averages in navigating the complexities of financial markets. Armed with this knowledge, readers are better equipped to construct their trading systems and embark on their journey towards trading mastery.

Stay tuned for Chapter 4, where we explore the intricacies of the Relative Strength Index (RSI) and its role in interpreting market momentum.

4: Relative Strength Index (RSI): Interpreting Market Momentum

In Chapter 4 of “The Art of Trading,” we delve into the Relative Strength Index (RSI) and its pivotal role in deciphering market momentum. Developed by J. Welles Wilder Jr., the RSI is a momentum oscillator that measures the speed and change of price movements, providing traders with insights into overbought and oversold conditions.

Smith begins by introducing readers to the calculation and interpretation of the RSI, emphasizing its ability to generate signals for potential trend reversals and continuation patterns. With a scale ranging from 0 to 100, the RSI indicates whether an asset is overbought (above 70) or oversold (below 30), offering traders valuable entry and exit points.

Through detailed charts and real-world examples, Smith demonstrates how traders can use the RSI to confirm trends identified by other indicators such as moving averages. By combining technical analysis tools, traders can increase the probability of successful trades while minimizing the risk of false signals.

Furthermore, Smith explores advanced RSI techniques such as divergence analysis, where discrepancies between price action and RSI readings can signal underlying strength or weakness in the trend. By paying attention to divergences between price and RSI, traders can anticipate potential trend reversals before they materialize on the price chart.

Readers are also introduced to the concept of RSI trendline analysis, where trendlines drawn on the RSI oscillator can provide additional insights into the strength and direction of the prevailing trend. By incorporating trendline analysis into their trading arsenal, traders gain a deeper understanding of market dynamics and can make more informed trading decisions.

As Chapter 4 concludes, readers emerge with a comprehensive understanding of the Relative Strength Index and its applications in deciphering market momentum. Armed with this knowledge, traders are better equipped to navigate the intricacies of financial markets and capitalize on profitable trading opportunities.

Stay tuned for Chapter 5, where we explore Bollinger Bands and their role in harnessing volatility for profit.

5: Bollinger Bands: Harnessing Volatility for Profit

In Chapter 5 of “The Art of Trading,” we delve into Bollinger Bands and their instrumental role in harnessing market volatility for profit. Developed by renowned technical analyst John Bollinger, Bollinger Bands are a versatile tool used by traders to identify potential trend reversals, measure volatility, and determine overbought and oversold conditions.

Smith begins by introducing readers to the construction of Bollinger Bands, which consist of a simple moving average (SMA) and two standard deviation bands plotted above and below the SMA. By dynamically adjusting to market volatility, Bollinger Bands expand and contract, providing visual cues of market volatility and potential trading opportunities.

Through practical examples and case studies, Smith demonstrates how traders can interpret Bollinger Bands to identify key trading signals. When prices touch or exceed the upper Bollinger Band, it may indicate overbought conditions, suggesting a potential reversal or pullback. Conversely, when prices touch or fall below the lower Bollinger Band, it may signal oversold conditions, hinting at a potential buying opportunity.

Furthermore, Smith explores the concept of Bollinger Band squeezes, where the bands contract tightly around price action, signaling a period of low volatility followed by a potential breakout. By recognizing Bollinger Band squeezes and anticipating subsequent price movements, traders can capitalize on explosive market trends and secure profitable trades.

Readers are also introduced to advanced Bollinger Band techniques such as Bollinger Band width analysis, which measures the width between the upper and lower bands to gauge volatility expansion or contraction. By monitoring changes in Bollinger Band width, traders can adapt their trading strategies to prevailing market conditions and optimize risk management.

As Chapter 5 draws to a close, readers emerge with a deep understanding of Bollinger Bands and their applications in navigating volatile market environments. Armed with this knowledge, traders can leverage Bollinger Bands to make informed trading decisions and achieve consistent profitability in today’s dynamic financial markets.

Stay tuned for Chapter 6, where we explore the Moving Average Convergence Divergence (MACD) indicator and its role in unveiling market trends with precision.

6: MACD: Unveiling Market Trends with Precision

In Chapter 6 of “The Art of Trading,” we explore the Moving Average Convergence Divergence (MACD) indicator and its pivotal role in unveiling market trends with precision. Developed by Gerald Appel, the MACD is a versatile momentum oscillator that measures the relationship between two moving averages, providing traders with insights into trend direction, momentum strength, and potential trend reversals.

Smith begins by introducing readers to the components of the MACD indicator, which consists of three main elements: the MACD line, the signal line, and the histogram. The MACD line is calculated by subtracting the longer-term exponential moving average (EMA) from the shorter-term EMA, while the signal line is a smoothed average of the MACD line. The histogram represents the difference between the MACD line and the signal line, providing visual cues of bullish and bearish momentum.

Through detailed charts and real-world examples, Smith demonstrates how traders can interpret MACD signals to make informed trading decisions. When the MACD line crosses above the signal line, it generates a bullish signal, suggesting potential buying opportunities. Conversely, when the MACD line crosses below the signal line, it generates a bearish signal, indicating potential selling opportunities.

Furthermore, Smith explores the concept of MACD divergence, where discrepancies between price action and MACD readings can signal underlying shifts in momentum. By paying attention to divergences between price and MACD, traders can anticipate potential trend reversals and adjust their trading strategies accordingly.

Readers are also introduced to advanced MACD techniques such as signal line crossovers and histogram analysis, which provide additional confirmation of trend direction and momentum strength. By incorporating these techniques into their trading arsenal, traders can enhance the accuracy of their trading signals and improve their overall trading performance.

As Chapter 6 concludes, readers emerge with a comprehensive understanding of the MACD indicator and its applications in unveiling market trends with precision. Armed with this knowledge, traders can leverage the power of MACD to navigate complex market environments and capitalize on profitable trading opportunities.

Stay tuned for Chapter 7, where we explore the Stochastic Oscillator and its role in identifying overbought and oversold conditions in the market.

7: Stochastic Oscillator: Identifying Overbought and Oversold Conditions

Chapter 7 of “The Art of Trading” delves into the Stochastic Oscillator and its crucial role in identifying overbought and oversold conditions in the market. Developed by George C. Lane in the late 1950s, the Stochastic Oscillator is a momentum indicator that compares a security’s closing price to its price range over a given period, offering traders insights into potential trend reversals and market turning points.

Smith begins by elucidating the calculation and interpretation of the Stochastic Oscillator, which consists of two lines: the %K line and the %D line. The %K line represents the current closing price relative to the high-low range over a specified period, while the %D line is a moving average of the %K line, providing smoother signals.

Through practical examples and visual aids, Smith demonstrates how traders can use the Stochastic Oscillator to identify overbought and oversold conditions. When the Stochastic Oscillator reaches or exceeds the 80 level, it indicates that the security is overbought and may be due for a reversal. Conversely, when the Stochastic Oscillator falls below the 20 level, it suggests that the security is oversold and may present a buying opportunity.

Furthermore, Smith explores the concept of Stochastic divergence, where discrepancies between price action and Stochastic readings can foreshadow potential trend reversals. By identifying divergences between price and Stochastic Oscillator, traders can anticipate shifts in market sentiment and adjust their trading strategies accordingly.

Readers are also introduced to advanced Stochastic techniques such as signal line crossovers and trendline analysis, which provide additional confirmation of overbought and oversold conditions. By incorporating these techniques into their trading arsenal, traders can refine their entry and exit points and improve the accuracy of their trading signals.

As Chapter 7 draws to a close, readers emerge with a comprehensive understanding of the Stochastic Oscillator and its applications in identifying overbought and oversold conditions in the market. Armed with this knowledge, traders can use the Stochastic Oscillator to enhance their trading strategies and capitalize on profitable trading opportunities.

Stay tuned for Chapter 8, where we explore Fibonacci Retracement and its role in unlocking price targets with mathematical precision.

8: Fibonacci Retracement: Unlocking Price Targets with Mathematical Precision

In Chapter 8 of “The Art of Trading,” we delve into Fibonacci Retracement and its crucial role in unlocking price targets with mathematical precision. Named after the renowned mathematician Leonardo Fibonacci, Fibonacci Retracement is a powerful tool used by traders to identify potential support and resistance levels based on the Fibonacci sequence.

Smith begins by introducing readers to the Fibonacci sequence and its application in financial markets. The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding ones, and it forms the basis for Fibonacci Retracement levels, which include 23.6%, 38.2%, 50%, 61.8%, and 100%.

Through detailed charts and real-world examples, Smith demonstrates how traders can use Fibonacci Retracement to identify key levels of support and resistance. By plotting Fibonacci Retracement levels on a price chart, traders can anticipate potential price reversals or continuation patterns, enabling them to make more informed trading decisions.

Furthermore, Smith explores the concept of Fibonacci extensions, which are used to identify potential price targets beyond the initial retracement levels. By projecting Fibonacci extension levels based on the magnitude of the price move, traders can set realistic profit targets and manage risk more effectively.

Readers are also introduced to advanced Fibonacci techniques such as Fibonacci clusters and confluence zones, where multiple Fibonacci levels align with other technical indicators or chart patterns. By identifying areas of confluence, traders can increase the probability of successful trades and minimize the impact of false signals.

As Chapter 8 draws to a close, readers emerge with a comprehensive understanding of Fibonacci Retracement and its applications in unlocking price targets with mathematical precision. Armed with this knowledge, traders can incorporate Fibonacci analysis into their trading strategies and gain a competitive edge in today’s dynamic financial markets.

Stay tuned for Chapter 9, where we explore the Ichimoku Cloud and its role as a comprehensive trading system.

9: Ichimoku Cloud: A Comprehensive Trading System

Chapter 9 of “The Art of Trading” explores the Ichimoku Cloud and its role as a comprehensive trading system. Developed by Japanese journalist Goichi Hosoda in the late 1930s, the Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile indicator that provides traders with insights into trend direction, support and resistance levels, and potential trading signals.

Smith begins by introducing readers to the components of the Ichimoku Cloud, which include the Kumo (cloud), Senkou Span A and Senkou Span B lines, Tenkan-sen (conversion line), and Kijun-sen (baseline). Each component of the Ichimoku Cloud serves a specific purpose in analyzing market dynamics and identifying trading opportunities.

Through practical examples and visual aids, Smith demonstrates how traders can interpret the Ichimoku Cloud to make informed trading decisions. The Kumo, or cloud, represents the area between the Senkou Span A and Senkou Span B lines and acts as a dynamic support and resistance zone. When the price is above the cloud, it indicates bullish momentum, while a price below the cloud suggests bearish sentiment.

Furthermore, Smith explores the concept of Kumo twists, where the Senkou Span A crosses above or below the Senkou Span B, signaling a potential change in trend direction. By paying attention to Kumo twists and other Ichimoku Cloud signals, traders can anticipate market reversals and adjust their trading strategies accordingly.

Readers are also introduced to advanced Ichimoku techniques such as Chikou Span confirmation and Kumo breakout strategies, which provide additional confirmation of trend direction and entry points. By incorporating these techniques into their trading arsenal, traders can increase the accuracy of their trading signals and improve their overall trading performance.

As Chapter 9 concludes, readers emerge with a comprehensive understanding of the Ichimoku Cloud and its role as a comprehensive trading system. Armed with this knowledge, traders can leverage the power of the Ichimoku Cloud to navigate complex market environments and capitalize on profitable trading opportunities.

Stay tuned for Chapter 10, where we explore Volume Analysis and its role in gauging market sentiment.

10: Volume Analysis: Gauging Market Sentiment

In Chapter 10 of “The Art of Trading,” we delve into Volume Analysis and its crucial role in gauging market sentiment. Volume is a key indicator in technical analysis, providing insights into the strength and conviction behind price movements. By analyzing volume patterns, traders can assess the participation of market participants and make informed trading decisions.

Smith begins by introducing readers to the concept of volume and its significance in trading. Volume represents the total number of shares or contracts traded during a specified period, and it serves as a measure of market activity. High volume often accompanies significant price movements, indicating strong conviction among traders, while low volume may signal indecision or lack of interest in the market.

Through detailed charts and real-world examples, Smith demonstrates how traders can interpret volume patterns to identify potential trading opportunities. For example, a surge in volume during an uptrend suggests bullish momentum and validates the strength of the trend. Conversely, a decrease in volume during a rally may signal weakening conviction and potential trend reversal.

Furthermore, Smith explores the concept of volume-based indicators such as On-Balance Volume (OBV) and Volume Weighted Average Price (VWAP), which provide additional insights into market sentiment. OBV tracks the cumulative volume flow, helping traders identify divergences between volume and price movements. VWAP calculates the average price weighted by volume, offering a benchmark for assessing the fair value of an asset.

Readers are also introduced to advanced volume analysis techniques such as volume profile and volume oscillators, which provide deeper insights into market dynamics and potential trading signals. By incorporating these techniques into their trading strategies, traders can gain a competitive edge and improve their overall trading performance.

As Chapter 10 draws to a close, readers emerge with a comprehensive understanding of Volume Analysis and its role in gauging market sentiment. Armed with this knowledge, traders can leverage volume patterns to identify high-probability trading opportunities and navigate the complexities of financial markets with confidence.

Stay tuned for Chapter 11, where we explore the art of combining multiple indicators for enhanced trading strategies.

11: Combining Indicators for Enhanced Trading Strategies

In Chapter 11 of “The Art of Trading,” we explore the art of combining multiple indicators for enhanced trading strategies. While individual indicators offer valuable insights into market dynamics, combining them can provide a more comprehensive view of price action and increase the accuracy of trading signals.

Smith begins by emphasizing the importance of selecting complementary indicators that offer different perspectives on market trends and momentum. By combining indicators with distinct characteristics, traders can reduce the likelihood of false signals and increase the reliability of their trading strategies.

Through practical examples and case studies, Smith demonstrates how traders can combine indicators such as moving averages, oscillators, and volume-based indicators to generate high-probability trading signals. For example, traders may use a combination of moving average crossovers and oscillator divergences to confirm trend reversals and identify entry and exit points.

Furthermore, Smith explores the concept of indicator confirmation, where signals from multiple indicators align to provide stronger confirmation of potential trading opportunities. By waiting for confirmation from multiple indicators before entering a trade, traders can increase the probability of success and minimize the risk of false signals.

Readers are also introduced to advanced techniques such as indicator weighting and optimization, where traders assign different levels of importance to each indicator based on their historical performance and relevance to current market conditions. By optimizing indicator parameters and weighting factors, traders can tailor their trading strategies to different asset classes and timeframes.

As Chapter 11 draws to a close, readers emerge with a deeper understanding of the power of combining indicators for enhanced trading strategies. Armed with this knowledge, traders can construct robust trading systems that adapt to changing market conditions and capitalize on profitable trading opportunities with confidence.

Stay tuned for Chapter 12, where we explore backtesting and optimization techniques to fine-tune trading strategies for maximum profitability.

12: Backtesting and Optimization Techniques

Chapter 12 of “The Art of Trading” delves into backtesting and optimization techniques, essential tools for fine-tuning trading strategies to maximize profitability. Backtesting involves applying a trading strategy to historical market data to evaluate its performance and identify areas for improvement. By backtesting, traders can gain valuable insights into the effectiveness of their strategies and make data-driven decisions.

Smith begins by outlining the steps involved in conducting a thorough backtest, including selecting appropriate historical data, defining clear trading rules, and analyzing the results. Through practical examples and case studies, readers learn how to use backtesting software to simulate trading scenarios and assess the performance of their strategies under various market conditions.

Furthermore, Smith explores the concept of optimization, where traders tweak their trading strategies’ parameters to maximize performance. By adjusting parameters such as moving average lengths, oscillator periods, and stop-loss levels, traders can optimize their strategies to achieve better risk-adjusted returns.

Readers are introduced to advanced optimization techniques such as genetic algorithms and machine learning, which automate the process of identifying optimal strategy parameters. By harnessing the power of algorithms and computational techniques, traders can expedite the optimization process and uncover hidden patterns in market data.

As Chapter 12 progresses, readers gain a deeper understanding of the importance of rigorous backtesting and optimization in developing robust trading strategies. Armed with this knowledge, traders can iterate on their strategies, refine their approaches, and adapt to changing market conditions with agility and precision.

Stay tuned for Chapter 13, where we explore risk management strategies for sustainable trading.

13: Risk Management Strategies for Sustainable Trading

Chapter 13 of “The Art of Trading” focuses on risk management strategies, a cornerstone of sustainable trading practices. While developing profitable trading strategies is essential, managing risk is equally crucial to long-term success in the financial markets. By implementing effective risk management techniques, traders can protect their capital, minimize losses, and preserve profitability over time.

Smith begins by emphasizing the importance of defining risk parameters and establishing clear guidelines for position sizing and risk exposure. Traders must determine their risk tolerance and set appropriate stop-loss levels to limit potential losses on each trade. Additionally, diversification across different asset classes and markets can help mitigate overall portfolio risk.

Through practical examples and case studies, Smith illustrates various risk management techniques, including the 1% rule, fixed fractional position sizing, and the Kelly Criterion. These methods help traders manage their capital efficiently and avoid catastrophic losses that can jeopardize their trading accounts.

Furthermore, Smith explores the concept of risk-reward ratios and how they influence trading decisions. By assessing the potential reward relative to the risk of each trade, traders can ensure that their profit targets outweigh potential losses, maintaining a positive expectancy in their trading strategies.

Readers are also introduced to advanced risk management techniques such as hedging and portfolio optimization. Hedging involves offsetting risks in one asset by taking an opposite position in another asset, reducing overall portfolio volatility. Portfolio optimization aims to allocate capital across different assets to achieve the optimal balance between risk and return.

As Chapter 13 concludes, readers gain a comprehensive understanding of risk management strategies and their importance in sustainable trading. Armed with this knowledge, traders can navigate the financial markets with confidence, knowing that they have robust risk management protocols in place to protect their capital and preserve long-term profitability.

Stay tuned for Chapter 14, where we delve into the psychology of trading and how mastering emotions is essential for success in the markets.

14: Psychology of Trading: Mastering Your Emotions

Chapter 14 of “The Art of Trading” delves into the psychology of trading and how mastering emotions is essential for success in the markets. While technical analysis and risk management are vital components of trading, understanding and controlling one’s emotions is equally critical. Emotions such as fear, greed, and impatience can cloud judgment and lead to costly mistakes.

Smith begins by exploring the psychological barriers that traders often face, such as fear of missing out (FOMO), the fear of losing (FOL), and the tendency to hold onto losing positions in hopes of a reversal (the “hope” trap). By recognizing these emotional pitfalls, traders can develop strategies to mitigate their impact on trading decisions.

Through real-life examples and anecdotes, Smith illustrates the detrimental effects of emotional trading and the importance of maintaining discipline and emotional control. Traders must learn to detach themselves from the outcome of each trade and focus on following their trading plan with consistency and objectivity.

Furthermore, Smith explores techniques for managing emotions during periods of market volatility and uncertainty. Techniques such as mindfulness, meditation, and visualization can help traders stay calm and focused during stressful trading situations, enabling them to make rational decisions based on analysis rather than emotion.

Readers are also introduced to the concept of trading psychology tools and resources, such as trading journals, performance metrics, and support networks. These tools can help traders track their progress, identify patterns in their behavior, and seek guidance and support from peers and mentors.

As Chapter 14 progresses, readers gain valuable insights into the psychological aspects of trading and how mastering emotions is essential for success in the markets. Armed with this knowledge, traders can cultivate the mental resilience and discipline needed to navigate the challenges of trading and achieve their long-term financial goals.

Stay tuned for Chapter 15, the final chapter of “The Art of Trading,” where we explore the process of developing a winning trading plan.

15: Developing a Winning Trading Plan

Chapter 15 of “The Art of Trading” focuses on the process of developing a winning trading plan. A trading plan serves as a roadmap for traders, outlining their goals, strategies, risk management rules, and performance metrics. By creating a well-defined trading plan, traders can maintain discipline, consistency, and accountability in their trading activities.

Smith begins by discussing the key components of a trading plan, including:

Trading Goals: Traders should establish clear and achievable goals, such as profit targets, risk tolerance levels, and performance benchmarks.

Trading Strategy: Traders must outline their trading strategy, including entry and exit rules, position sizing criteria, and criteria for selecting trading opportunities.

Risk Management Rules: Traders should define their risk management rules, including stop-loss levels, position sizing guidelines, and maximum risk per trade or per day.

Trading Schedule: Traders should establish a trading schedule that fits their lifestyle and allows them to trade during optimal market conditions.

Performance Evaluation: Traders should set up a system for tracking and evaluating their performance, including keeping a trading journal, analyzing trading metrics, and reviewing their trades regularly.

Through practical examples and case studies, Smith demonstrates how traders can create a personalized trading plan tailored to their individual goals, preferences, and risk tolerance. By following a trading plan consistently, traders can minimize emotional decision-making and increase their chances of long-term success in the markets.

Furthermore, Smith explores the importance of adapting and refining the trading plan over time based on changing market conditions, personal experiences, and feedback from performance evaluations. A trading plan should be dynamic and flexible, allowing traders to adjust their strategies and tactics as needed to stay ahead of the curve.

As Chapter 15 concludes, readers gain a comprehensive understanding of the process of developing a winning trading plan. Armed with this knowledge, traders can embark on their trading journey with confidence, knowing that they have a clear roadmap to guide them towards their financial goals.

With the completion of Chapter 15, “The Art of Trading” comes to a close. I hope you found this comprehensive guide insightful and valuable on your journey to mastering the art of trading in the dynamic financial markets of 2024 and beyond.