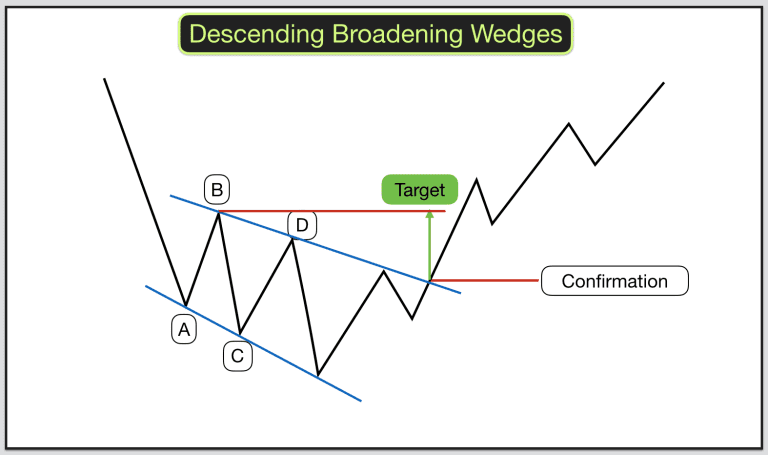

A right-angled descending broadening wedge is a reversal pattern that typically appears during a correction in a bullish movement, signaling a potential change in the trend. This pattern is characterized by a widening formation where the support line slopes downward more steeply than the resistance line. Traders can identify this pattern by observing two touches on each trendline, with prices broadening over time. The descending broadening wedge often indicates a buying opportunity after a downtrend or during an existing uptrend. It is considered bullish and has a high success rate for breakouts to the upside, with about 80% odds of an upward breakout

4.To trade the descending broadening wedge reversal pattern effectively, traders can enter the market by placing a buy order when the price breaks above the top side of the wedge. It is crucial to wait for the candle to close above the top trendline to confirm the breakout and avoid false signals. Stop-loss orders should be placed below the bottom of the broadening wedge to manage risk, while profit targets can be calculated by measuring the height of the back of the wedge and extending that distance from the breakout point4.In summary, a right-angled descending broadening wedge is a bullish continuation pattern that traders can capitalize on by recognizing its formation, entering trades strategically upon confirmation of breakouts, and managing risk effectively through stop-loss orders and profit targets.

what are the characteristics of a right-angled descending broadening wedge

The characteristics of a right-angled descending broadening wedge include the following key points:

- Formation: The right-angled descending broadening wedge consists of a horizontal top trendline and a downward-sloping bottom trendline13.

- Trendlines: The top trendline is horizontal, while the bottom trendline slopes downward5.

- Touches: This pattern typically has at least five touches in total, with three peaks or valleys touching the associated trendline and two or more touches of the other trendline. Ideally, the second of three touches should touch the trendline instead of just coming close to it5.

- Breakout Direction: Upward breakouts occur around 64% of the time5.

- Volume Trend: A rising volume trend during the formation of the pattern leads to the best post-breakout performance5.

- Partial Rise and Decline: A partial rise works around 47% of the time, while a partial decline works about 75% of the time5.

- Price Trend: The best-performing patterns are those with an intermediate-term price trend leading to the formation of the pattern5.

These characteristics are essential for identifying and trading the right-angled descending broadening wedge pattern effectively in the financial markets.

what are the common indicators used to identify a right-angled descending broadening wedge

Common indicators used to identify a right-angled descending broadening wedge pattern include:

- Support and Resistance Lines: The pattern consists of two diverging trendlines, with the support line sloping downward more steeply than the resistance line25.

- Multiple Touches: Each trendline should have at least two touches, with three peaks or valleys touching the associated trendline and two or more touches of the other trendline25.

- Volume Trend: Volumes tend to increase during the formation of the pattern and are at their maximum when prices break through the pattern15.

- Breakout Confirmation: Traders can confirm the pattern by waiting for a breakout above the top side of the wedge and ensuring that the candle closes above the top trendline25.

- Stop-Loss Placement: Stop-loss orders are typically placed below the bottom of the broadening wedge to manage risk effectively25.

- Profit Targets: Profit targets can be calculated by measuring the height of the back of the wedge and extending that distance from the breakout point25.

These indicators are crucial for traders to accurately identify and trade a right-angled descending broadening wedge pattern in financial markets.