The right-angled ascending broadening wedge pattern is a chart pattern that indicates a likely selling opportunity after an uptrend or an existing downtrend. This pattern consists of a horizontal support line and a sloping resistance line, with prices hitting both lines twice. Traders can enter a short position when the price breaks below the horizontal support line or encounters resistance at the lower trend line. The stop-loss should be placed above the back of the wedge, and the profit target is calculated by measuring the height of the wedge and extending that distance down from the breakout123. A partial rise in this pattern occurs when the price rises off the lower trend line but doesn’t reach the upper trend line before falling back to the lower trend line. Conversely, a partial decline happens when the price falls off the upper trend line but doesn’t reach the lower trend line before rising back to the upper trend line4. In summary, traders can identify a right-angled ascending broadening wedge pattern by observing price movements relative to its horizontal support and sloping resistance lines. This pattern typically signifies a potential selling opportunity after certain price movements within the wedge structure.

how to identify a right-angled ascending broadening wedge pattern on a chart

To identify a right-angled ascending broadening wedge pattern on a chart, you need to look for specific characteristics outlined in the search results:

- Structure: The right-angled ascending broadening wedge pattern consists of a horizontal support line and an upward sloping resistance line345.

- Price Movements: Prices should touch both the horizontal support line and the sloping resistance line at least twice, forming two hits on each line134.

- Partial Rise: A partial rise occurs when the price rises off the lower trend line but doesn’t reach the upper trend line before falling back to the lower trend line14.

- Chart Analysis:

- Look for three peaks and three valleys with tops and bottoms forming three touches to each trendline.

- The upper trendline should rise more steeply than the lower trendline, creating a broadening wedge shape4.

- Trading Strategy:

By observing these key elements in price movements and chart structures, traders can effectively identify a right-angled ascending broadening wedge pattern on a chart.

what is the difference between a right-angled ascending broadening wedge and a descending broadening wedge

The difference between a right-angled ascending broadening wedge and a descending broadening wedge lies in their structure, implications, and trading strategies:

- Structure:

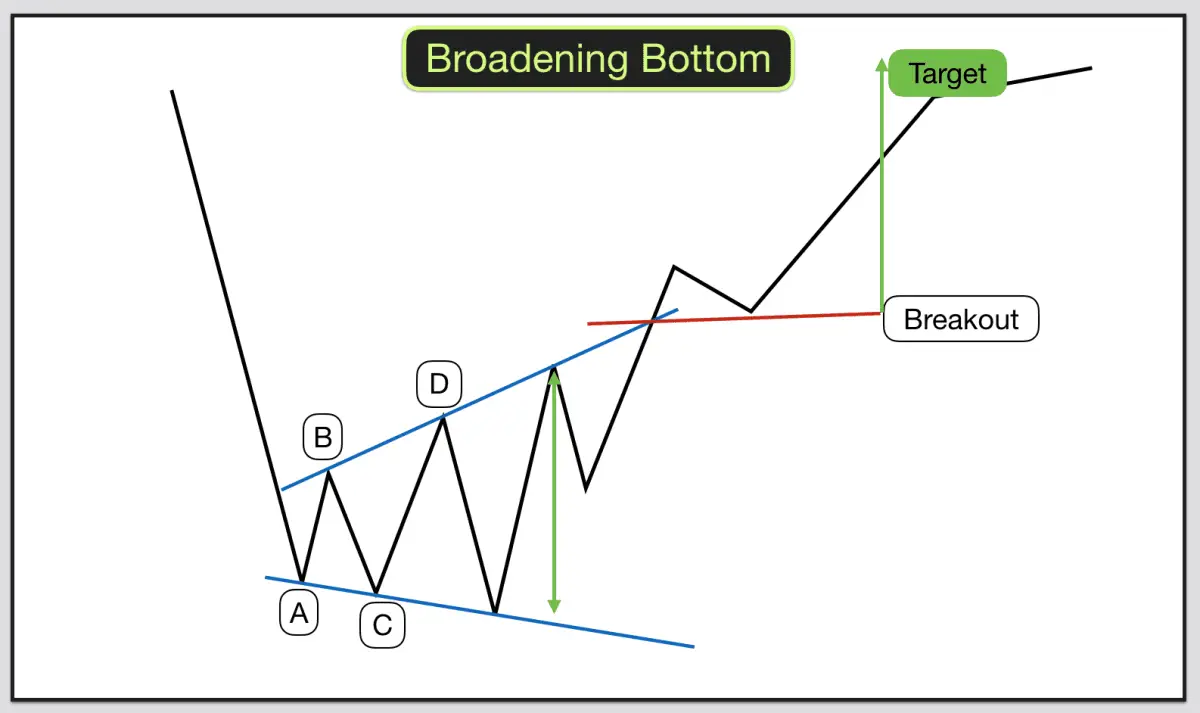

- Right-Angled Ascending Broadening Wedge: This pattern consists of a horizontal bottom and an upward sloping trendline. It is characterized by a right angle formed by two diverging trendlines45.

- Descending Broadening Wedge: In contrast, the descending broadening wedge has a horizontal top followed by a downward sloping trendline. The pattern widens as the two trendlines diverge from each other3.

- Implications:

- Right-Angled Ascending Broadening Wedge: It is considered a downward reversal pattern, reflecting growing nervousness and indecision among investors. This pattern may indicate a lack of buyers in a bullish movement, leading to a potential reversal4.

- Descending Broadening Wedge: The descending broadening wedge is typically a reversal pattern that suggests a buying opportunity after a downtrend or during an existing uptrend. It is seen as a bullish pattern, even though a continuation of the downtrend is still possible3.

- Trading Strategies:

- Right-Angled Ascending Broadening Wedge: Traders can enter the market by placing a sell order when the price breaks below the horizontal support line or encounters resistance at the lower trendline. The stop-loss is usually placed above the back of the wedge, and the profit target is calculated by measuring the height of the wedge and extending that distance down from the breakout5.

- Descending Broadening Wedge: For this pattern, traders can enter the market by placing a buy order when the price breaks above the top side of the wedge or finds support at the upper trendline. The stop-loss is typically placed below the back of the wedge, and the profit target is calculated by taking the height of the back of the wedge and extending that distance up from the breakout3.

In summary, the key distinctions between a right-angled ascending broadening wedge and a descending broadening wedge lie in their structure, implications for price movements, and the corresponding trading strategies employed by traders to capitalize on these patterns.