Reversal Patterns Ascending broadening wedge

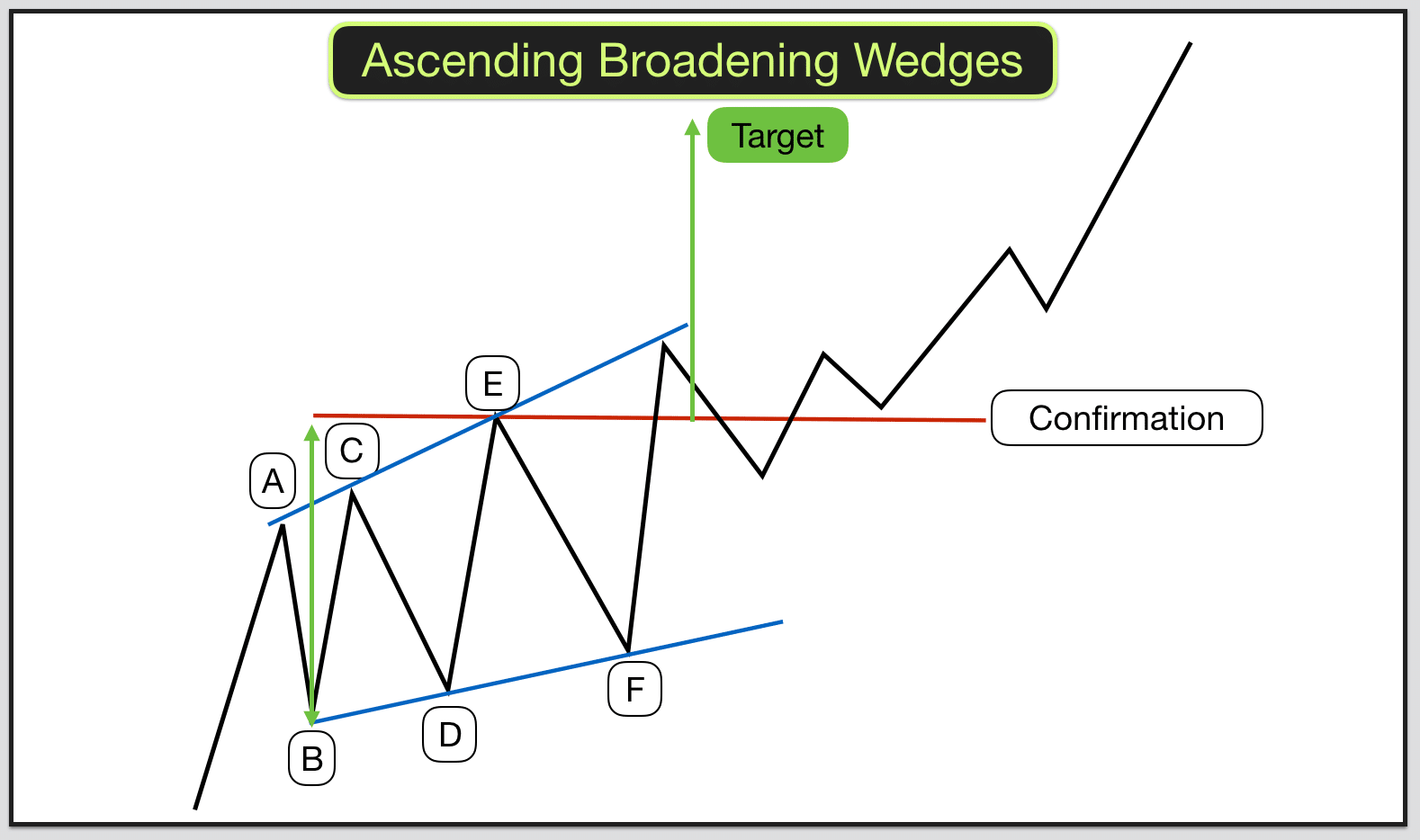

An ascending broadening wedge is a bearish chart pattern that is considered a reversal pattern. It is characterized by two diverging bullish lines, with the upper line acting as resistance and the lower line as support. This pattern indicates the sellers’ ambition to take control rather than the exhaustion of buying pressure. The price continues to increase with movements of increasing magnitude, showing that buyers are losing control. The pattern is confirmed when the price touches the support line at least three times and the resistance line twice. An ascending broadening wedge can occur after a bullish movement or during a correction in a bearish movement, signaling either a bearish reversal or continuation pattern respectively.

how to identify an ascending broadening wedge pattern

To identify an ascending broadening wedge pattern, follow these key steps based on the information from the sources provided:

- Formation: The pattern starts with a series of higher highs and lower lows. The trend lines drawn from these peaks and troughs will start to diverge, creating the broadening shape124.

- Trend Lines: Look for two diverging trend lines that connect a series of higher highs and higher lows. The upper line acts as resistance, and the lower line acts as support. Both lines should slope upwards, with the upper line sloping more steeply than the lower line45.

- Touches: The pattern should have at least three peaks and three valleys that touch their respective trend lines. Each of these lines must have been touched at least three times to confirm the pattern45.

- Confirmation: An ascending broadening wedge is confirmed when there is good oscillation between the two upward lines. The upper line is the resistance line, and the lower line is the support line34.

By following these steps and paying attention to the characteristics of the pattern, traders can effectively identify an ascending broadening wedge pattern on a price chart.

what is the difference between an ascending broadening wedge and a descending broadening wedge

The difference between an ascending broadening wedge and a descending broadening wedge lies in their formation, implications, and market signals:

- Formation:

- Ascending Broadening Wedge: This pattern is characterized by two diverging bullish lines where the upper line (resistance) rises at a steeper rate than the lower line (support), creating a broadening shape as the price moves between them123.

- Descending Broadening Wedge: In contrast, a descending broadening wedge has two converging bearish lines where the upper line (resistance) slopes less steeply than the lower line (support), forming a broadening shape as the price fluctuates within these boundaries45.

- Implications:

- Ascending Broadening Wedge: It is considered a bearish reversal pattern that indicates sellers’ ambition to take control over buyers, often leading to a downward breakout after the pattern is confirmed123.

- Descending Broadening Wedge: On the other hand, a descending broadening wedge is bullish and signifies a reversal pattern where bears lose control, and bulls start dominating the market, potentially leading to an upward breakout once confirmed45.

- Market Signals:

- Ascending Broadening Wedge: This pattern typically appears at the end of an uptrend and signals a potential reversal to a downtrend. Traders may enter short positions when prices break through the lower trendline123.

- Descending Broadening Wedge: It emerges after a downtrend and indicates a shift from bearish to bullish sentiment. Traders might consider long positions when prices break above the upper trendline45.

In summary, while both patterns involve broadening shapes with diverging or converging trend lines, an ascending broadening wedge suggests a bearish reversal, while a descending broadening wedge indicates a bullish reversal in market trends.