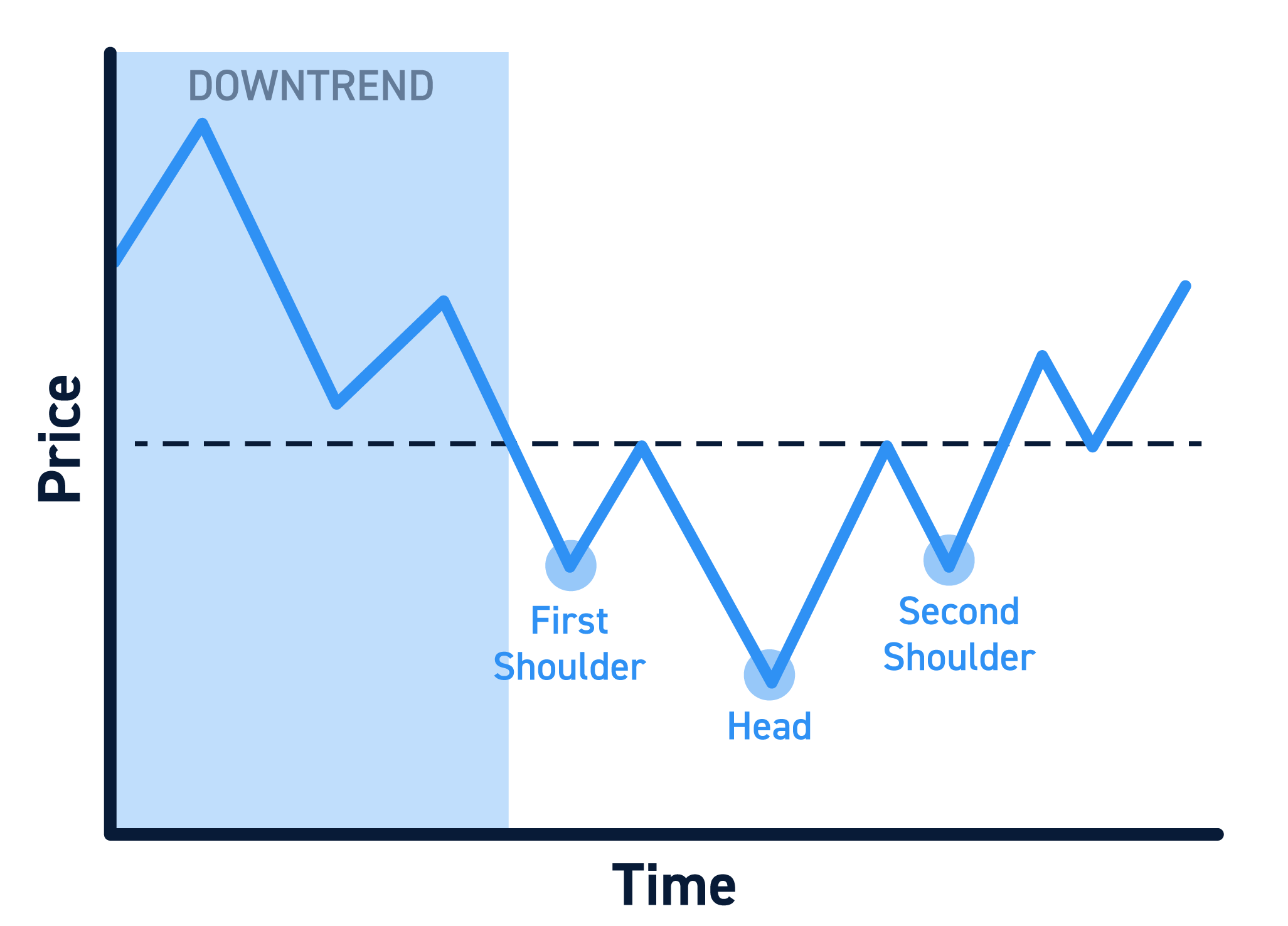

The head and shoulders (H&S) reversal pattern is a significant technical analysis pattern used in trading to signal potential trend reversals. It consists of three peaks: the middle peak (head) is higher than the other two (shoulders). This pattern indicates a transition from a bullish to a bearish trend. Traders often look for an entry point below the “neckline” after a breakout, with stop loss orders placed above the right shoulder. Technical indicators like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are commonly used for confirmation. The inverse head and shoulders pattern is its bullish counterpart, signaling a potential reversal from a downtrend to an uptrend. Both patterns are essential tools for traders to identify potential market reversals and make informed trading decisions

what are the key characteristics of a head and shoulders reversal pattern

The key characteristics of a head and shoulders reversal pattern are as follows:

- Formation: The pattern consists of three peaks: the middle peak (head) is higher than the other two (shoulders).

- Trend Reversal: It signals a transition from a bullish to a bearish trend.

- Neckline: A trendline connecting the peaks after the formation of each shoulder and the head acts as a level of support or resistance.

- Volume: Volume patterns play a crucial role in confirming the pattern, especially in bottom formations.

- Confirmation: A breakout below the neckline confirms the pattern.

- Trading Strategy: Traders often enter short positions after the neckline breakout, with stop-loss orders placed above the right shoulder.

- Symmetry: While symmetry is preferred, it is not an absolute requirement; shoulders can have different widths and heights.

- Reliability: Considered one of the most reliable trend reversal patterns in technical analysis.

These characteristics define the head and shoulders reversal pattern and are essential for traders to identify and interpret this significant chart formation accurately

what is the difference between a head and shoulders pattern and an inverse head and shoulders pattern

The main difference between a head and shoulders pattern and an inverse head and shoulders pattern lies in their directional bias and the market conditions they signal:

- Directional Bias: A head and shoulders pattern is a bearish reversal pattern that indicates a potential trend reversal from bullish to bearish. It consists of a peak (the head) between two smaller peaks (the shoulders). On the other hand, an inverse head and shoulders pattern is a bullish reversal pattern signaling a potential trend reversal from bearish to bullish. It features a trough (the head) between two smaller troughs (the shoulders).

- Market Conditions: A head and shoulders pattern typically forms at the peak of an uptrend, signaling a potential downtrend ahead. In contrast, an inverse head and shoulders pattern usually forms at the bottom of a downtrend, indicating a potential uptrend.

- Structure: The head and shoulders pattern has three peaks with the middle peak being the highest, while the inverse head and shoulders pattern has three troughs with the middle trough being the lowest.

- Trading Strategy: Trading these patterns involves different approaches based on their directional bias. Traders may enter short positions after a head and shoulders pattern confirmation for bearish trades, while they may enter long positions after an inverse head and shoulders pattern confirmation for bullish trades.

Understanding these differences is crucial for traders to effectively interpret these chart patterns and make informed trading decisions based on the market conditions they indicate