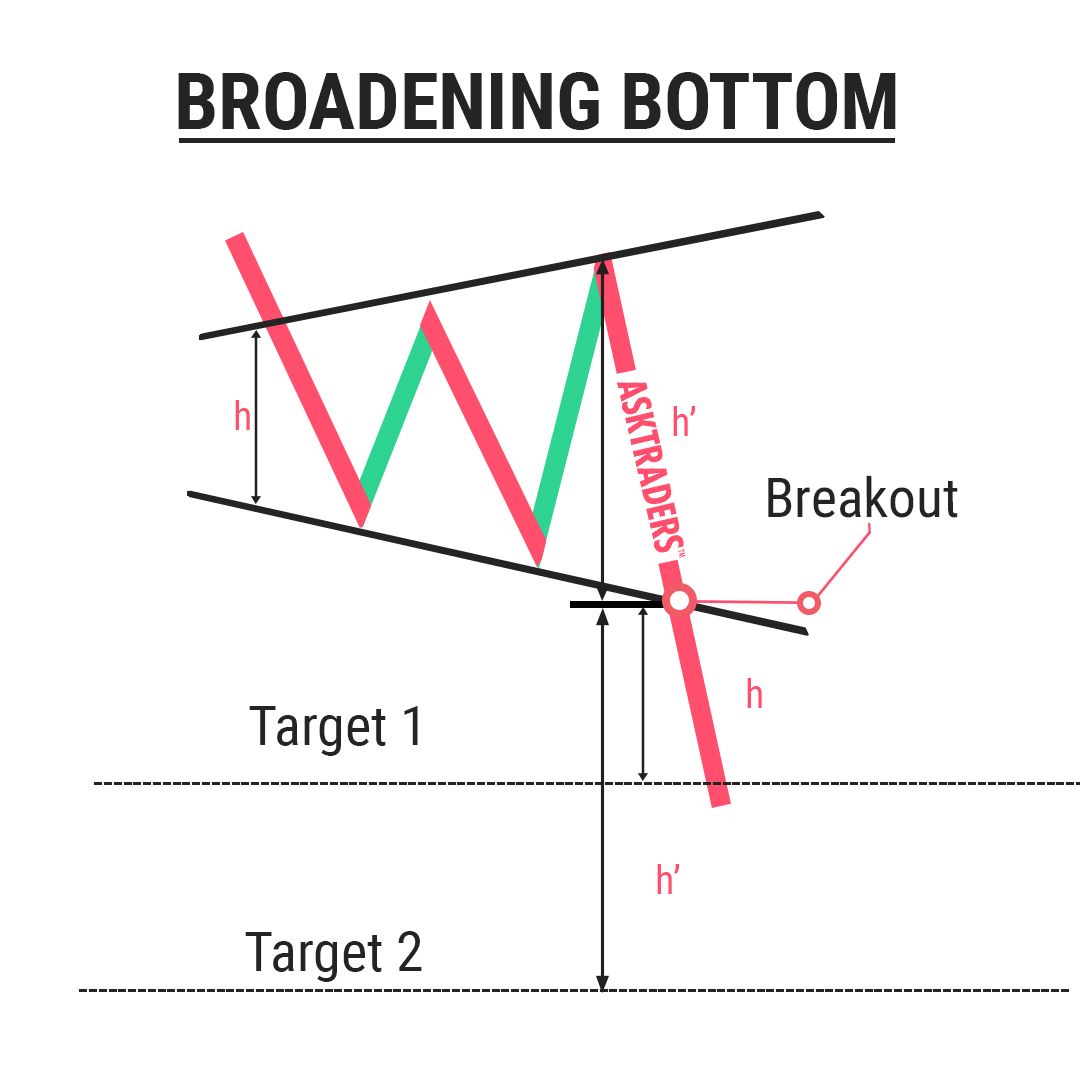

A broadening bottom is a bullish reversal pattern characterized by two divergent lines that are horizontally symmetric, forming a reverse symmetrical triangle. This pattern reflects growing investor nervousness and indecision, often following a bearish movement. The price objective is determined by plotting the top point of the triangle at its start where it breaks out. Trading strategies for broadening bottoms include traditional long and short positions at breakout points, with stop losses and specific objectives based on the pattern’s characteristics1234.

In terms of performance statistics, broadening bottoms tend to have a bullish exit in 58% of cases, with the pattern’s objective achieved using specific techniques. However, bearish exits can increase to 70%, especially when the price is in the lower third of its annual range. It’s important to note that broadening bottoms are considered patterns of indecision, with bearish potential often greater than bullish potential in the event of a break25.

what are some common trading strategies for broadening bottom patterns

Common trading strategies for broadening bottom patterns include:

- Traditional Long Position Strategy:

- Entry: Take a long position at the breakout above the upper trend line.

- Stop Loss: Place the stop loss below the recent lows.

- Objective: Theoretical objective of the pattern.

- Advantage: High probability of trade success.

- Traditional Short Position Strategy:

- Entry: Take a short position at the breakout below the lower trend line.

- Stop Loss: Place the stop loss above the support.

- Objective: Theoretical objective of the pattern.

- Advantage: High probability of trade success.

- Aggressive Strategy:

- Entry: Take a long position at the support and a short position at the resistance.

- Stop Loss: Place the stop above/below the last lowest/highest point.

- Objective: Opposite terminal of the triangle.

- Advantage: Potential for a large number of contact points.

- Disadvantage: Pattern may not be easy to spot initially.

These strategies offer different approaches to trading broadening bottom patterns, catering to varying risk tolerances and trading styles

what are some common indicators used to identify broadening bottom patterns

Common indicators used to identify broadening bottom patterns include:

- Symmetrical Horizontal Lines: The pattern is formed by two symmetrical horizontal lines that are divergent, creating a reverse symmetrical triangle.

- Shape Characteristics: Broadening bottoms have higher peaks and lower valleys, resembling a megaphone shape.

- Trendlines: The top trend line slopes upward, while the bottom one slopes downward. At least five touches are expected, with three peaks or valleys touching the associated trend line.

- White Space: Price should cross the pattern from side to side, filling the area with price movement.

- Volume: Upward breakouts occur 65% to 67% of the time, indicating a potential bullish reversal.

These indicators help traders identify and confirm broadening bottom patterns, providing insights into potential bullish reversals in the market