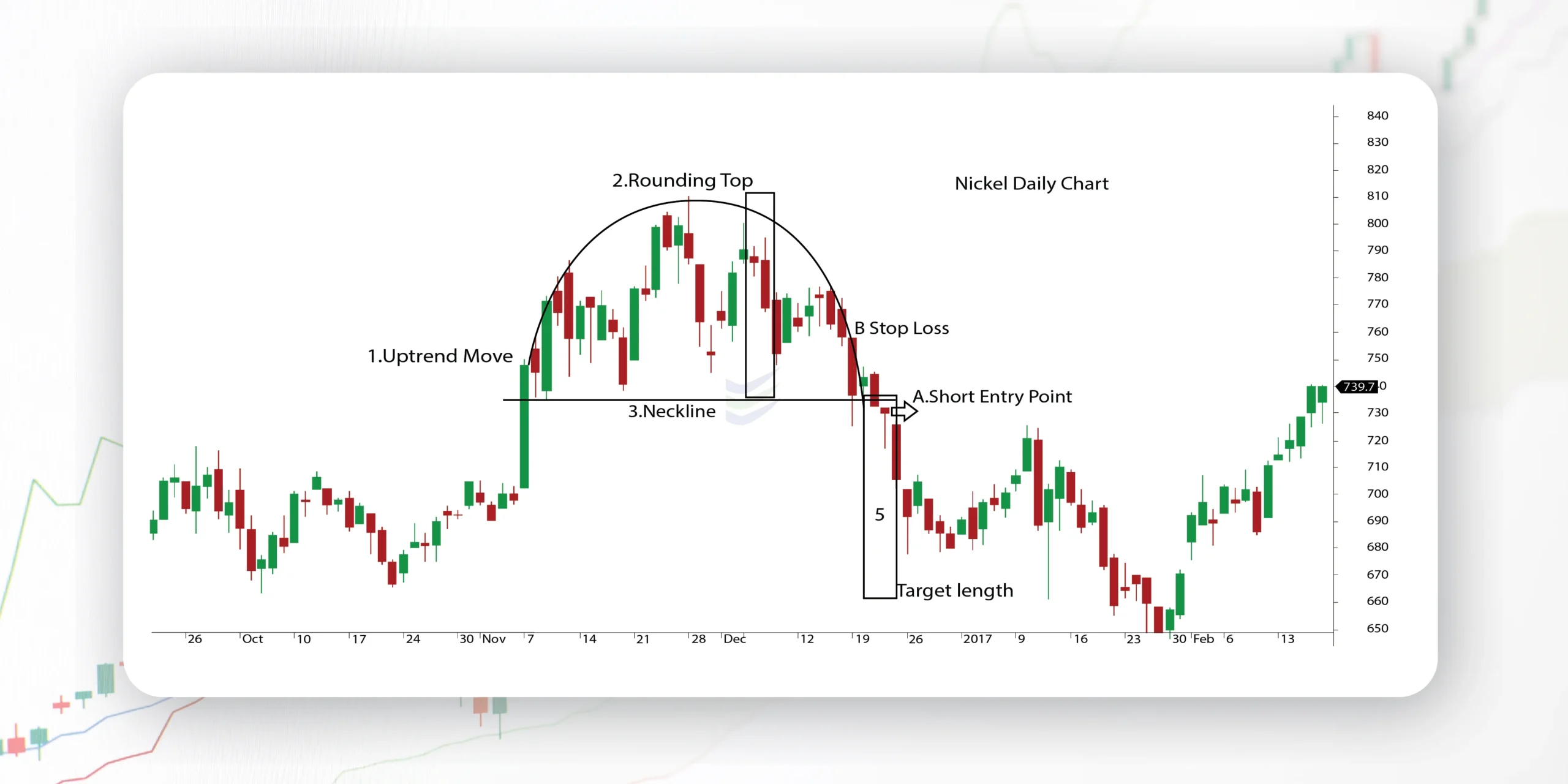

A rounding bottom is a chart pattern used in technical analysis that signifies a positive market reversal at the end of extended downward trends. It is identified by a series of price movements forming a “U” shape, indicating a shift from bearish to bullish sentiment. Traders consider it a rare occurrence, with the pattern’s time frame ranging from weeks to months. Volume and price ideally move together to confirm the pattern, with volume peaking at the beginning of the decline and on the approach to the previous high. The pattern resembles a saucer or bowl, and its completion suggests a new upward trend. Traders can use the rounding bottom pattern for potential trades by confirming the pattern, identifying the bottom neckline, waiting for the breakout, entering a trade, setting a stop loss, and determining a target based on the pattern’s size

what are some common mistakes to avoid when trading the rounding bottom pattern

When trading the rounding bottom pattern, there are common mistakes that traders should avoid to improve their success rate. Some of these mistakes include:

- Entering or Exiting Trades Too Quickly: Rushing into or out of trades without waiting for proper confirmation can lead to losses due to false breakouts or whipsaw movements5.

- Lack of Patience: Failing to let the setup play out completely can result in missed opportunities or premature exits, impacting trading results negatively5.

- Poor Risk Management: Neglecting to set stop-loss orders or having an unclear exit strategy can expose traders to significant losses if the trade goes against them5.

- Ignoring Confirmation Signals: Disregarding important bullish reversal signals like high volume, candlestick formations, and oscillator divergence can lead to entering trades prematurely or missing key entry points5.

- Not Setting Profit Targets: Failing to establish clear profit targets based on the pattern’s size or Fibonacci retracement levels can result in missed opportunities to capitalize on price movements5.

- Holding onto Losing Positions: Refusing to exit losing trades promptly and hoping for a miraculous recovery can lead to increased losses and negatively impact overall trading performance5.

By avoiding these common mistakes and following a well-defined trading plan that includes proper risk management, patience, and adherence to confirmation signals, traders can enhance their chances of success when trading the rounding bottom pattern.

what are some effective entry and stop-loss strategies for trading rounding bottom patterns

Effective entry and stop-loss strategies are crucial when trading rounding bottom patterns to maximize success and minimize risks. Here are some key strategies based on the provided sources:

Entry Strategies:

- Breakout Entry: A common approach is to enter the trade once the price breaks above the resistance level, confirming the reversal. This breakout signals a shift from bearish to bullish sentiment1.

- Wait for Pattern Completion: Another effective strategy is to wait for the pattern to complete and then buy on the breakout above the resistance level. This approach ensures confirmation of the pattern before entering the trade4.

Stop-Loss Strategies:

- Stop-Loss Below the Neckline: Traders often set their stop-loss orders just below the neckline of the rounding bottom pattern. Placing the stop-loss in this position helps protect against potential losses if the trade goes against them5.

- Proper Risk Management: Employing proper risk management techniques is essential when setting stop-loss levels. Traders should consider factors like the risk-reward ratio and market conditions to determine the optimal placement of stop-loss orders5.

By following these entry and stop-loss strategies, traders can enhance their trading decisions when dealing with rounding bottom patterns, increasing the likelihood of successful trades while managing risks effectively.