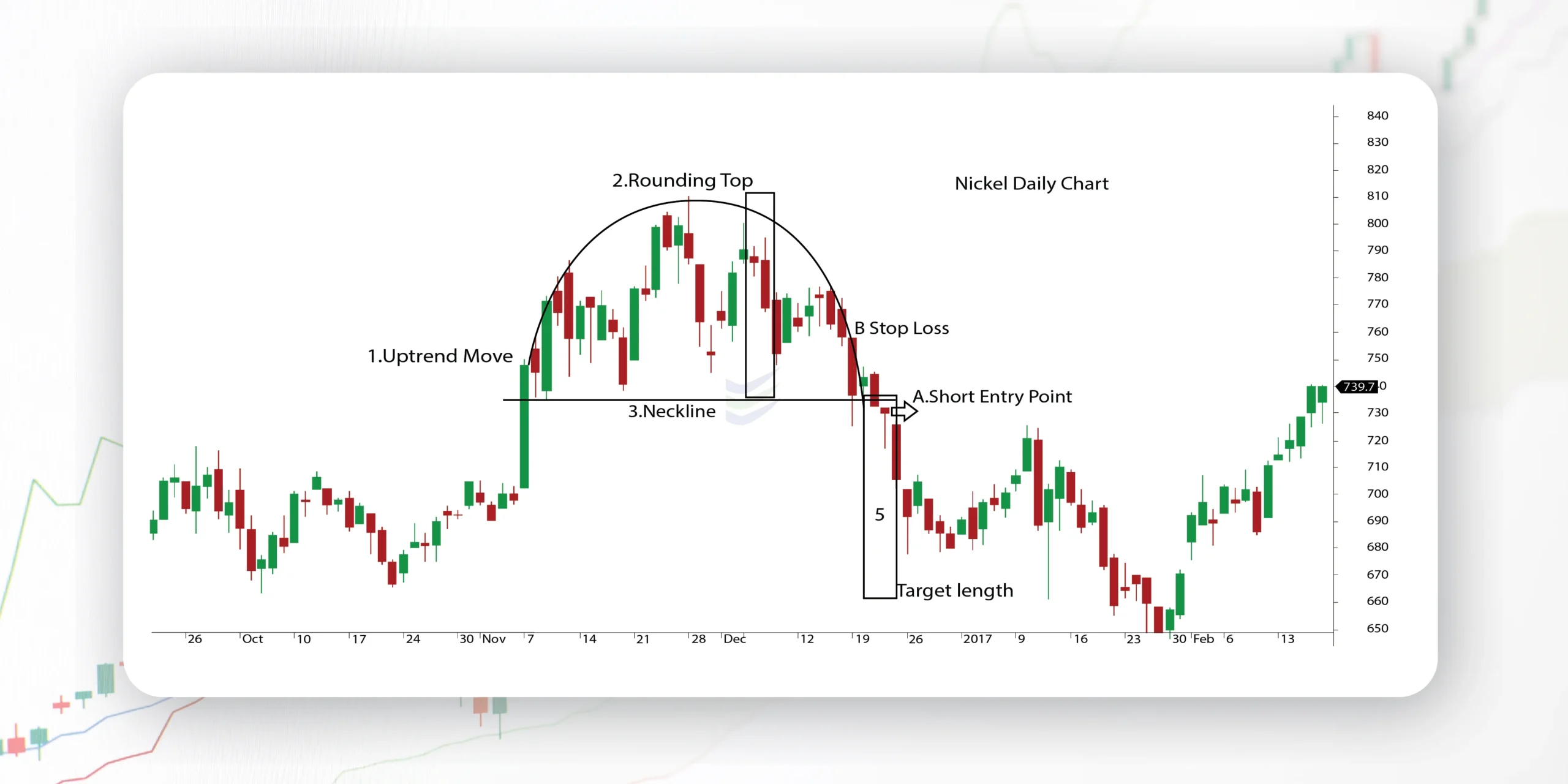

The rounding top pattern is a bearish reversal pattern that appears at the end of a bullish trend. It is characterized by prices slowing down and forming a rounded shape resembling an inverted “U.” Traders typically wait for the price to close below the neckline before entering a short position, with stop-loss orders placed above the neckline and take-profit levels set based on the distance from the peak to the neckline245. The rounding top pattern indicates a potential reversal from a bullish to a bearish market sentiment, suggesting a shift in sentiment with selling pressure gradually increasing as the price flattens and rounds off at the top. Traders often look for confirmation of this pattern through a breakdown below support levels, signaling the beginning of a downtrend.

how can i identify a rounding top pattern on a chart

To identify a rounding top pattern on a chart, follow these key steps based on the information from the sources provided:

- Recognize an Uptrend: The rounding top pattern occurs during an uptrend, characterized by a series of higher highs and lower lows1.

- Observe Stalled Price Action: Look for a period of stalled price action after the uptrend, where the price movement becomes flat or exhaustive1.

- Draw the Rounding Top: The rounding top has a distinct appearance of periodic highs that decrease in magnitude, forming a curve with a downward slope. Draw a trend line approximating the periodic highs to visualize the pattern12.

- Identify the Neckline: The neckline is a support level that defines the lower extreme of the rounding top pattern. It is crucial for confirming the pattern12.

- Confirm Breakout: The rounding top pattern is complete when the price breaks and closes below the neckline. This breakout signals a potential trend reversal from bullish to bearish2.

By following these steps and paying attention to the shape of the price movement on the chart, the curvature of the highs, and the breakout below the neckline, you can effectively identify a rounding top pattern as a potential signal for a trend reversal in technical analysis

how can i differentiate a rounding top pattern from a rounding bottom pattern

To differentiate a rounding top pattern from a rounding bottom pattern, consider the following key points from the provided sources:

- Pattern Direction:

- Rounding Top: A rounding top pattern indicates a potential reversal from a bullish (uptrend) to a bearish (downtrend) market sentiment4.

- Rounding Bottom: In contrast, a rounding bottom pattern is a bullish reversal pattern, suggesting a likelihood of a reversal higher and offering buying opportunities2.

- Shape:

- Rounding Top: The rounding top has a gradual, rounded curvature at the top of the price chart, resembling an upside-down saucer or bowl. It signifies a shift in sentiment with selling pressure gradually increasing as the price flattens and rounds off at the top4.

- Rounding Bottom: On the other hand, the rounding bottom has an inverse shape, forming a gentle “U” or inverted arc with initial lows, lower lows in the middle, and higher lows on the right-hand side2.

- Market Implication:

- Rounding Top: Traders look for confirmation through a breakdown below support levels to indicate the beginning of a downtrend after identifying a rounding top pattern4.

- Rounding Bottom: The presence of a rounding bottom pattern suggests a shift in power between sellers and buyers, indicating buying interest overcoming selling pressure and signaling a potential bullish reversal2.

By understanding these distinctions in terms of pattern direction, shape, and market implications, traders can effectively differentiate between a rounding top and a rounding bottom pattern when analyzing price charts for potential trend reversals