A bullish flag is a continuation pattern found in stocks with strong uptrends, indicating a potential move higher. This pattern resembles a flag on a pole, where the pole represents a vertical rise in the stock price, and the flag results from a period of consolidation.

The breakout from a bullish flag often leads to a powerful upward movement, typically measuring the length of the prior flag pole. Bull flags are considered reliable continuation patterns that signal the continuation of an existing bull trend. They are characterized by a strong rise in the stock forming the flag pole, followed by a tight consolidation towards the top of the pole before breaking out with strong volume

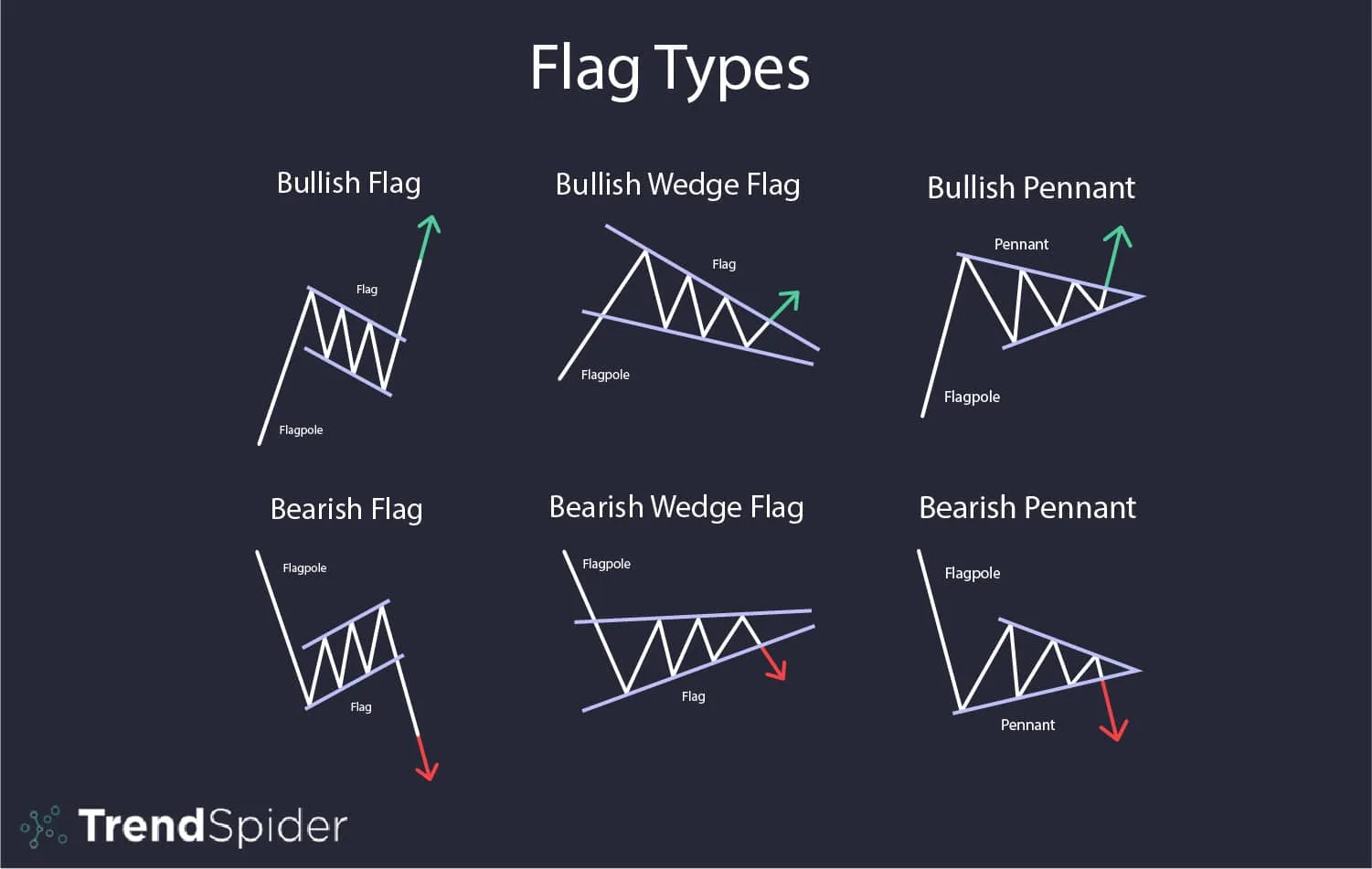

what is the difference between a bullish flag and a bullish pennant

The main difference between a bullish flag and a bullish pennant lies in their shapes and formations within the context of technical analysis:

- Bullish Flag:

- Shape: Bullish flags are characterized by a rectangular shape that slants against the prevailing trend.

- Trendlines: The trendlines of a bullish flag are parallel, and the pattern typically forms after a sharp price movement.

- Volume: Volume usually decreases during the formation of a bullish flag.

- Duration: These patterns form over a short period of time, ranging from several days to several weeks.

- Trading: Traders enter a long position when price action breaks above the upper trendline (resistance) with a stop-loss placed just below the lower trendline (support)135.

- Bullish Pennant:

- Shape: Bullish pennants are characterized by a symmetrical triangle shape that forms after a strong upward price move.

- Trendlines: The trendlines of a bullish pennant converge, forming a mini triangle, and the pattern indicates the continuation of a bull market.

- Volume: Volume usually decreases during the consolidation phase of a bullish pennant.

- Duration: Bullish pennants occur over various time frames and are identified by a pronounced upward movement (pole) followed by a symmetrical triangle consolidation.

- Trading: Traders identify a bullish pennant by watching for a breakout beyond the resistance levels, entering long positions when the market moves beyond these levels with a stop-loss placed below the lower trendline4.

In summary, while both patterns are bullish continuation patterns, a bullish flag has a rectangular shape with parallel trendlines, forming after a sharp price movement, while a bullish pennant takes the shape of a symmetrical triangle with converging trendlines, indicating a continuation of a bull market after a strong upward price move.

what are some common trading strategies for bullish pennant patterns

Some common trading strategies for bullish pennant patterns include:

- Breakout Trading: Traders often wait for a breakout above the upper trendline of the bullish pennant to enter a long position. This breakout is typically accompanied by increased volume, signaling a potential upward move124.

- Entry Points: Traders can enter a trade after the breakout from the pennant pattern. For a bullish pennant, this entry point occurs when the price breaks above the upper trendline, indicating a potential continuation of the uptrend4.

- Take Profit Levels: Instead of using the original range of the pennant to plan where to take profit, traders often look to match the size of the prior bullish move that preceded the consolidation. This means setting profit targets based on the length of the initial bullish leg before the consolidation phase12.

- Stop Loss Placement: Stop-loss orders are crucial for managing risk. In a bullish pennant, traders typically place their stop-loss just below the support trendline to protect against potential downside risk. This ensures that losses are limited if the pattern fails to continue as expected124.

- Risk-Reward Ratio: Bullish pennants are favored by traders due to their high risk-reward ratio. The distance between the entry point and the stop-loss is usually closer than the distance between the entry point and the take-profit level. This favorable risk-reward ratio makes bullish pennants attractive for traders seeking profitable opportunities12.

These strategies help traders navigate the bullish pennant pattern effectively, providing clear guidelines on entry points, take-profit levels, stop-loss placement, and risk management to optimize trading outcomes.