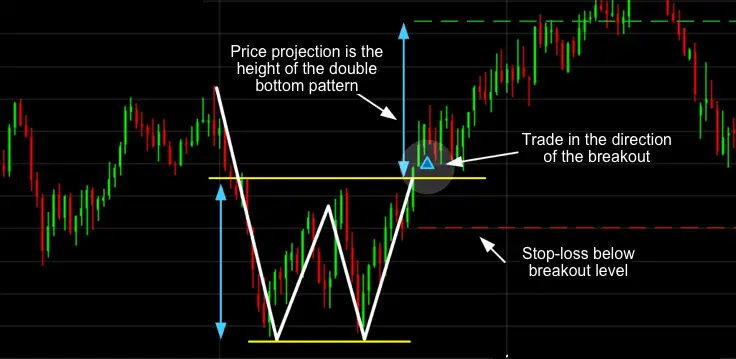

A double bottom pattern is a bullish reversal pattern that typically occurs at the end of a downtrend. It consists of two consecutive troughs that are roughly equal, with a moderate peak in-between, resembling the letter “W.” This pattern signals a change in trend from bearish to bullish. The formation is considered active once the price breaks above the neckline, shifting from lower lows and lower highs to higher lows and higher highs.

Traders should look for key indicators like volume spikes during upward price movements for confirmation. Patience is crucial as the pattern needs time to develop, with at least 4 weeks between lows being preferable. The advance off the first trough should be 10-20%, and the second trough should form a low within 3% of the previous low. Volume indicators like Chaikin Money Flow can be used to identify buying pressure. It is essential to wait for a resistance breakout before confirming the pattern.

What is the difference between a double top and a double bottom

The main difference between a double top and a double bottom lies in their implications for market direction. A double top is a bearish reversal pattern that forms after an extended uptrend, indicating a potential trend reversal from bullish to bearish. It consists of two peaks that fail to break a certain resistance level, suggesting selling pressure and exhaustion of buying momentum. Traders typically look to enter short positions when the price breaks below the neckline, anticipating a downtrend

234.On the other hand, a double bottom is a bullish reversal pattern that occurs after an extended downtrend, signaling a potential shift from bearish to bullish. It comprises two troughs that fail to break a specific support level, indicating buying pressure and exhaustion of selling momentum. Traders usually consider entering long positions when the price breaks above the neckline, expecting an uptrend135.In summary, while a double top indicates a bearish reversal and suggests selling opportunities after an uptrend, a double bottom signals a bullish reversal and presents buying opportunities following a downtrend.

what are some common indicators used to identify double top and double bottom patterns

Common indicators used to identify double top and double bottom patterns include:

- Neckline: The neckline is a critical element in identifying these patterns. It connects the lows for a double bottom and the highs for a double top. Traders look for a breakout above or below the neckline to confirm a potential trend reversal13.

- Volume: Monitoring volume during the formation of these patterns is essential. A spike in volume during the two upward price movements in a double bottom or double top provides strong confirmation of upward price pressure and the validity of the pattern34.

- Support/Resistance Levels: In a double top formation, the highest point of each peak is considered a resistance level, while in a double bottom formation, the lowest point of each trough is seen as a support level. Understanding these levels helps traders make informed decisions about entering or exiting trades14.

- Confirmation of Breakout: One key indicator is waiting for confirmation of the pattern before entering a trade. This confirmation is usually indicated by a breakout above or below the neckline, which acts as a support or resistance level12.

- Market Fundamentals: Validating the pattern with a change in market fundamentals for the security, sector, and overall market conditions is crucial. Fundamentals reflecting an upcoming reversal in market conditions, coupled with volume spikes, provide further confirmation of a true double bottom or double top pattern3.

By utilizing these indicators and carefully analyzing price movements, traders can effectively identify and interpret double top and double bottom patterns to make informed trading decisions.