A falling wedge pattern is a bullish signal in technical analysis. It indicates a potential reversal of a downtrend, suggesting that a sliding price is losing momentum and buyers are starting to enter the market to slow down the fall2.

This pattern is characterized by a cone-shaped formation that slopes down as reaction highs and lows converge, signaling a likely trend reversal or continuation1. To confirm a falling wedge pattern, traders look for a breakout above the upper resistance line, often accompanied by increased trading volume, which demonstrates market conviction behind the breakout1. The falling wedge can be challenging to trade accurately as it involves recognizing lower highs and lower lows while a security is in a downtrend1. Overall, the falling wedge pattern is considered bullish and can provide valuable insights into potential bullish reversals or continuations in trading strategies.

what is the difference between a falling wedge and a rising wedge

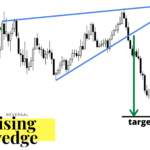

The main difference between a falling wedge and a rising wedge lies in their implications for price movements. A falling wedge is a bullish pattern that forms when prices are in a downtrend and indicates a potential reversal to the upside. On the other hand, a rising wedge is a bearish pattern that occurs in an uptrend and signals a potential reversal to the downside235. In summary:

- Falling Wedge:

- Bullish pattern.

- Forms in a downtrend.

- Indicates a potential reversal to the upside.

- Rising Wedge:

what are some common indicators used to identify a rising wedge pattern

Some common indicators used to identify a rising wedge pattern include:

- Converging Trendlines: Look for two ascending trendlines that converge towards each other, with the upper trendline being steeper than the lower one24.

- Volume: Decreasing volume levels during the formation of a rising wedge pattern can indicate a lack of market conviction and suggest an impending breakout2.

- Support and Resistance Levels: Strong support and resistance levels that form the two sides of the triangle can help confirm the pattern2.

- Price Action: Observing a series of lower highs and higher lows within the narrowing range of prices enclosed by the upward-sloping trendlines4.

These indicators, when used together, can help traders effectively identify and confirm a rising wedge pattern for potential trading opportunities